Product Description

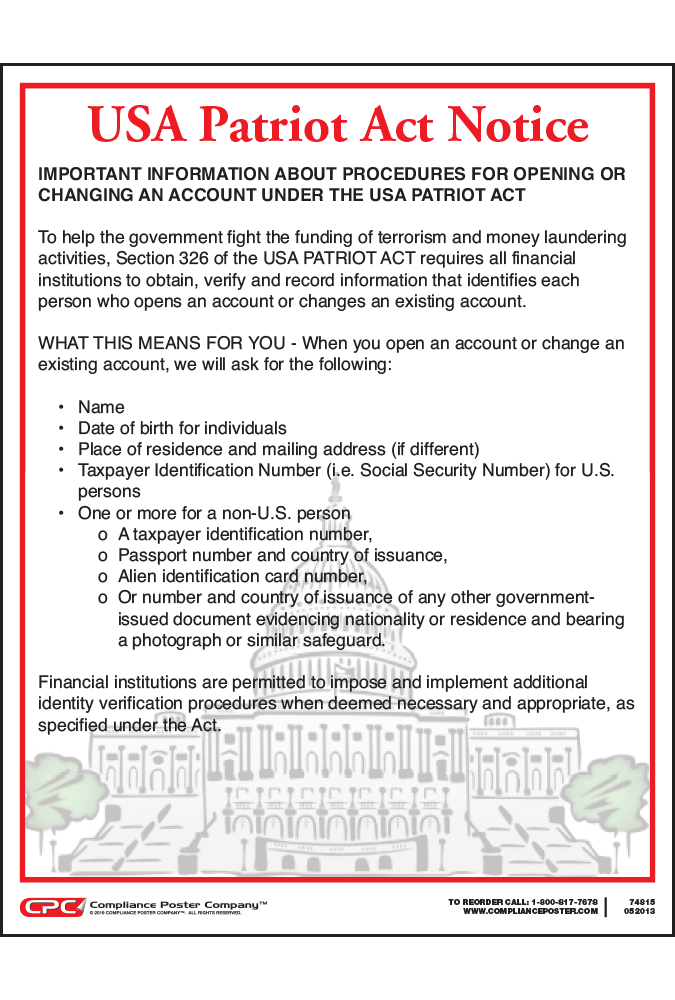

The USA PATRIOT Act Notice provides important information for customers who wish to open or change an account with a financial institution. This mandatory notice provides basic information about the financial institution’s obligations under the USA PATRIOT Act to help fight the funding of terrorism and money laundering activities, including the obligation to collect identifying information from U.S. persons and non-U.S. persons.

Under the USA PATRIOT Act, financial institutions are required to implement a Customer Identification Program (CIP) which involves obtaining, verifying and recording identifying information for each person who opens an account or changes an existing account. The financial institution must, at a minimum, collect the name, date of birth, address, and identification number (such as a taxpayer identification number or passport number) for each individual.

The financial institution may impose and implement additional identity verification procedures when deemed necessary and appropriate.

There is space provided at the bottom of the poster for each financial institution to insert an individualized policy statement. To order a customized version of the USA PATRIOT Act Notice with your policy statement printed on the notice, contact CPC by email, chat, or phone.

Posting Requirement

The USA PATRIOT Act Notice must be posted in the lobby of a financial institution, where it can be easily viewed by clients and prospective clients. (31 C.F.R. §1020.220(5)(i – iii)). Financial institutions are also permitted to satisfy the notice requirement by other means besides posting, so long as they provide the notice in a manner “reasonably designed to ensure that a customer is able to view the notice.”

Financial institutions subject to this requirement include banks, credit unions, savings associations, and certain non-federally regulated banks.