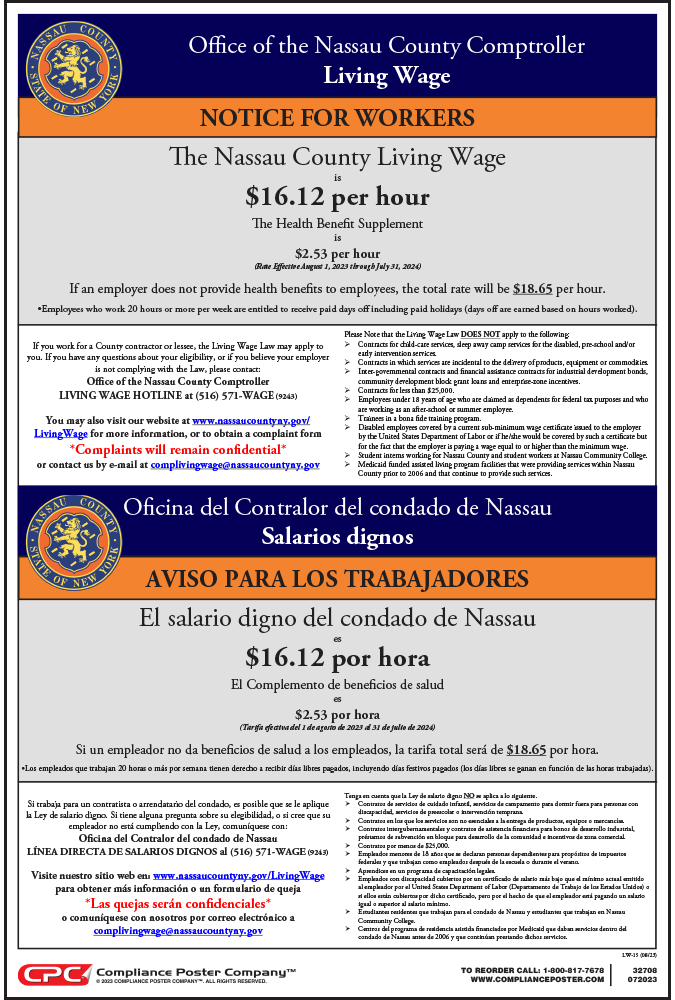

The Nassau County Living Wage Law requires that a specified minimum wage be paid to employees of service contractors and lessees that perform County work. Covered employers must either provide employees with benefits or supplement their hourly wage rate by an amount no less than the benefits supplement rate. Employers are also required to provide employees who work 20 hours or more per week a maximum of 12 paid days off per year.

The poster includes the living wage rates and a list of exempt employees. The poster also describes how to submit a complaint if an employer is not complying with the law.

Posting Requirements

Covered employers are required to provide written notification of the adjusted living wage and the health benefit supplement rates and effective date of the change to each covered employee at least seven days prior to the effective date. The Nassau County Living Wage poster must be displayed in a conspicuous place at each covered work site/location.