Who must post the 2025 Vermont Minimum Wage Peel ‘N Post?

Vermont’s Minimum Wage Law applies to employers employing two or more employees. (21 VSA §382) Employers covered by the Minimum Wage Law are required to post the 2025 Vermont Minimum Wage Notice in a conspicuous place in the area where employees are employed. (21 VSA §393)

Covered employers with remote employees can keep these employees informed of the current minimum wage rate by distributing 2025 Vermont Minimum Wage Peel ‘N Post stickers to update existing Mobile Poster Paks, or by providing a new 2025 Vermont Mobile Poster Pak to remote workers.

What’s new?

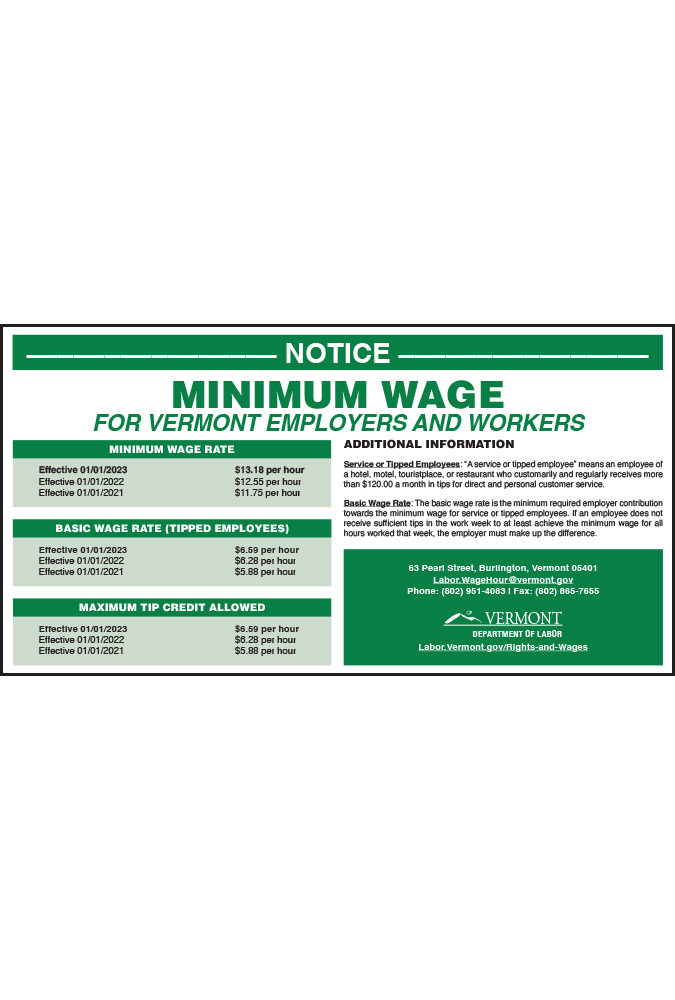

The 2025 Vermont Minimum Wage posting reflects the annual adjustment to the:

- Minimum Wage Rate

- Basic Wage Rate (Tipped Employees)

- Maximum Tipped Credit Allowed

How is the Vermont minimum wage rate calculated?

- Each year, the general minimum wage rate is adjusted for inflation, measured by the rate that the Consumer Price Index increased over the preceding year. The minimum wage calculation is rounded off to the nearest $0.01. In no event is the minimum wage decreased. (21 VSA § 384)

- The Basic Tipped Wage Rate for service or tipped employees equals 50% of the general minimum wage rate. If a tipped employee receives less than the Basic Wage Rate with tips and cash wages combined, the employer must make up the difference.

- Maximum Tipped Credit Allowed is amount of a service or tipped employee’s actual hourly average tip earnings that an employer may credit toward the employer’s obligation to pay its employees no less than the general minimum wage rate.