What is the West Hollywood, CA Minimum Wage Law?

The West Hollywood Minimum Wage Ordinance establishes a minimum wage for employees working within the West Hollywood geographic boundaries for an employer, wherever located. Employees are covered by the Ordinance if they work at least two (2) hours per week within city limits and qualify as an employee under the Labor Code.

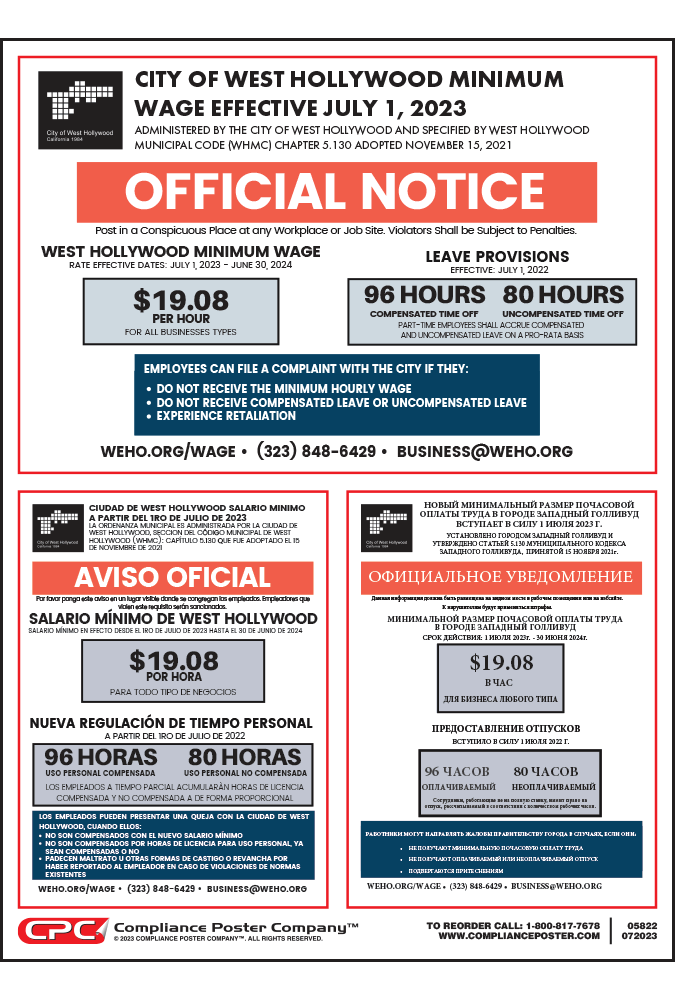

Under the Ordinance, the minimum wage rate is scheduled to increase incrementally through July 1, 2023. Every July 1 thereafter, the minimum wage rate will be adjusted based on annual increases in the Consumer Price Index. Tips and medical benefits cannot be used to offset the minimum wage. The law also requires employers to provide employees with paid leave and uncompensated leave beginning July 1, 2022. The Ordinance requirements for minimum wage and leave provisions can only be waived through bona fide collective bargaining agreement.

What does the West Hollywood Minimum Wage Poster cover?

The Minimum Wage Ordinance specifies different wage rates for large and small businesses. Large business are defined as businesses with 50 or more individual employees within the United States, regardless of where those employees work. Small businesses are defined as businesses with 49 or fewer employees within the United States, regardless of where those employees work.

The Minimum Wage Poster informs employees of:

- the West Hollywood, CA Municipal Code Minimum Wage chapter number

- the posting requirement and penalty notice

- the current minimum wage rate and effective dates for large and small employers

- employees’ right to file a complaint with the City if they do not receive the minimum hourly wage or experience retaliation

- the City’s minimum wage website, telephone and email address contact information

What are West Hollywood’s posting & recordkeeping requirements?

- Employers are required to post in a conspicuous place at any workplace or job site where a covered employee works, the official Minimum Wage notice published by the City each time the minimum wage rate increases, in English, Spanish and any other language spoken by at least five percent (5%) of the employees.

- Employers must provide in writing the employer’s name, address, and telephone number to all new and current employees.

- Employers must retain payroll records for a period of three (3) years.