In order to provide you with the most up-to-date postings, this item has been placed on hold pending a mandatory change. Should you need this item for an inspection or other immediate need, please call CPC at (800) 817-7678 to have the item shipped immediately. Otherwise, orders for this item will ship as soon as the update becomes available.

Who should post the IRS Earned Income Tax Credit (EITC) Wall Chart?

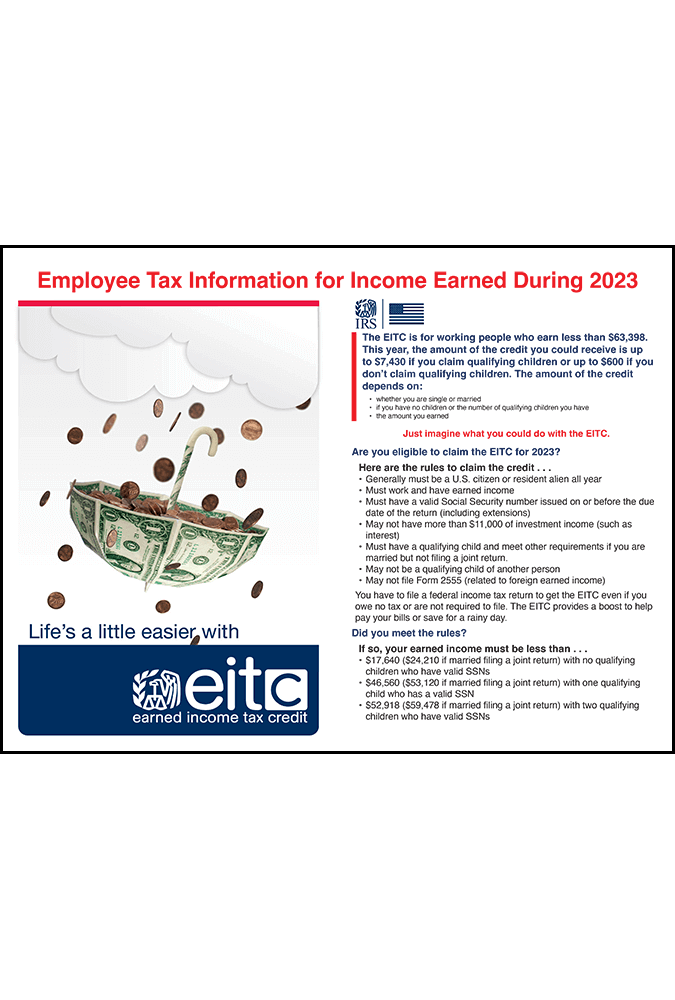

- The Earned Income Tax Credit (EITC) is a refundable federal income tax credit for low to moderate income working individuals and families. The tax benefit is given to qualifying individuals as a credit on their income tax return.

- Federal law requires an employers to give notice of the EITC tax credit directly to any employee who did not have not income tax withheld from his/her wages. (See IRS Notice #1015).

- The IRS encourages employers to inform all potentially eligible employees of the tax benefit. Posting the EITC Wall Chart in the workplace makes information about the EITC tax credit readily accessible to all potentially eligible employees and achieves the exposure suggested by the IRS.

What does the IRS Earned Income Tax Credit (EITC) Wall Chart cover?

The IRS Earned Income Tax Credit (EITC) Wall Chart includes:

- IRS Notice #797, Possible Federal Tax Refund Due to the Earned Income Credit (EIC) – Notice provides:

- a brief description about the EIC credit and who may claim it;

- the maximum amount of credit that can be claimed, based on the number of qualifying children the taxpayer has, if any;

- how to claim the EIC;

- how to qualify for free tax preparation assistance; and

- where to access more information.

2. IRS Publication #962 – Publication provides:

- detailed eligibility rules;

- income maximums based on the number of qualifying children the employee can claim, and qualifying without a qualifying child;

- qualifying child tests; common errors in claiming the benefit; and

- online resources and organizations providing EITC assistance and tax preparation help.

3. IRS Qualifying Child Rules covers:

- Four tests for a qualifying child – age, relationship, residency and joint return;

- Limitation on who may claim a qualifying child and “tie-breaker rules”; and

- Claiming the tax benefit without having a qualifying child.