What is the Hayward, California Minimum Wage Rate?

The City of Hayward Minimum Wage Ordinance was approved on April 14, 2020.

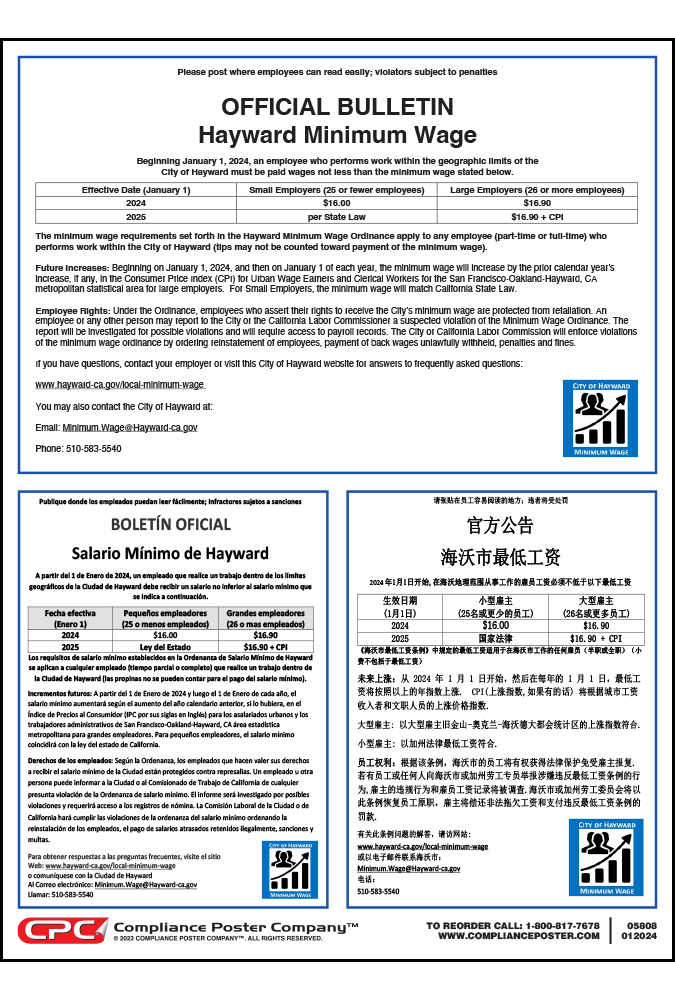

- Beginning January 1, 2025, large employers with 26 or more employees are subject to a $17.36/hour minimum wage. The minimum wage for large employers will be adjusted on each January 1, by the Consumer Price Index (CPI) for the San Francisco-Oakland-Hayward region with a maximum increase not to exceed 5%.

- Beginning January 1, 2025, small employers with 25 or fewer employees are subject to a $16.50/hour minimum wage per State Law and any future increase in accordance to the State Minimum Wage Law.

Who must post the Hayward, California Minimum Wage Poster?

The law requires all Hayward employers to post in a conspicuous place at any workplace or job site where an employee works the notice published each year by the City informing employees of the current minimum wage rate and of their rights under this chapter. Every employer is required to post such notices in the top three languages spoken in the city based on the latest available census information for the city. (Hayward Muni. Code § 6-15.15)

Are there other employer requirements?

In addition to paying all employees who perform work within the geographic boundaries of the city no less than the minimum wage for each hour worked and posting the annual Hayward, California Minimum Wage Poster, Hayward employers must:

- At the time of hire, provide the employee with a written copy of the employer’s name, address, and telephone number.

- Document all hours worked by employees and retain payroll records for at least four (4) years.