Oakland, CA Minimum Wage, Paid Sick Leave & Service Charge Law Poster Description

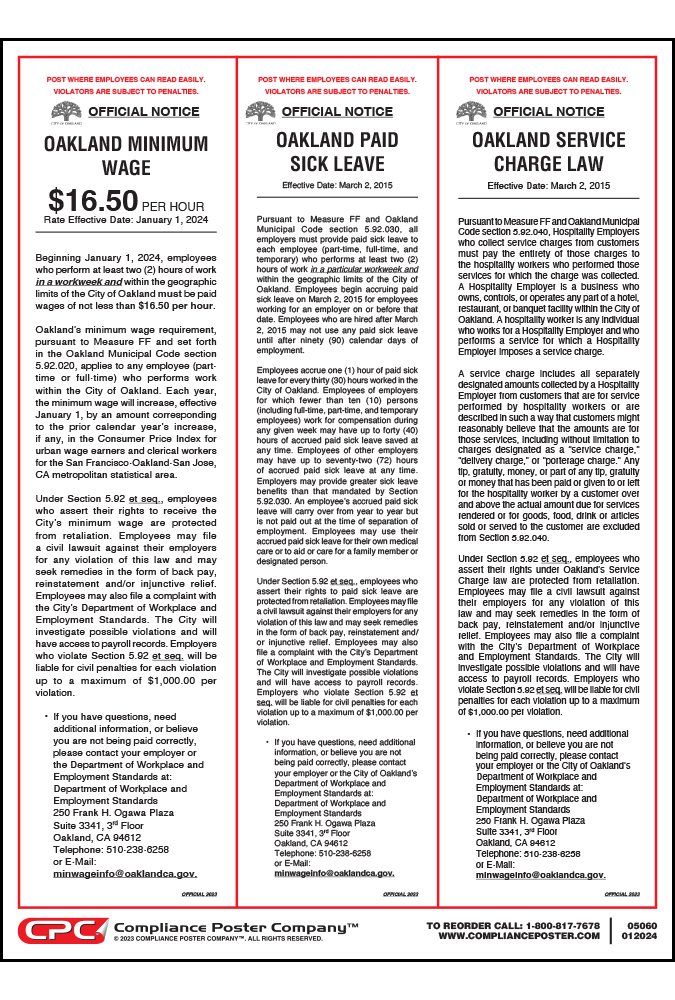

- The Oakland, CA Minimum Wage, Paid Sick Leave & Service Charge Law Poster shows the City of Oakland’s effective Minimum Wage Rate and terms of the Paid Sick Leave and Service Charge Law. Oakland Municipal Code Chapter 5.92 establishes the City’s Minimum Wage, Paid Sick Leave and Service Charge standards. These laws apply to employees who perform at least two (2) hours of work in a particular workweek within Oakland, including part-time, temporary and seasonal employees.

- Employers must pay employees for work performed in the City at least the effective minimum wage rate. The minimum wage rate is adjusted for inflation each January 1, based on the Consumer Price Index.

- Employers are also required to provide paid sick leave to any employee working within Oakland. Employees accrue one (1) hour of paid sick leave for every thirty (30) hours worked. For small businesses there is an annual cap of forty (40) hours. For other employers, there is an annual cap of seventy-two (72) hours. Employees may use the leave for their own illness or injury or medical care, or to care for a family member with an illness, injury or who is receiving medical care.

- Hospitality employers (such as hotels, restaurants, and banquet facilities) who collect service charges from customers must distribute the entirety of those charges to the hospitality workers who performed the services.

Enforcement

The prohibits an employer from retaliating against an employee for making a compliant to the City or for exercising civil remedies to enforce his or her rights. Employers are subject to civil penalties for violations of the law.

Notice & Recordkeeping

- Employers must post and give written notification of these rights to each current employee and to each new employee at the time of hire.

- The notice must be provided in all languages spoken by more than ten percent (10%) of the employees.

- Employers are also required to maintain payroll records, Paid Sick Leave accruals, and Service Charge collection and distribution records for a period of three (3) years.