Who must post the Petaluma, CA Minimum Wage Poster?

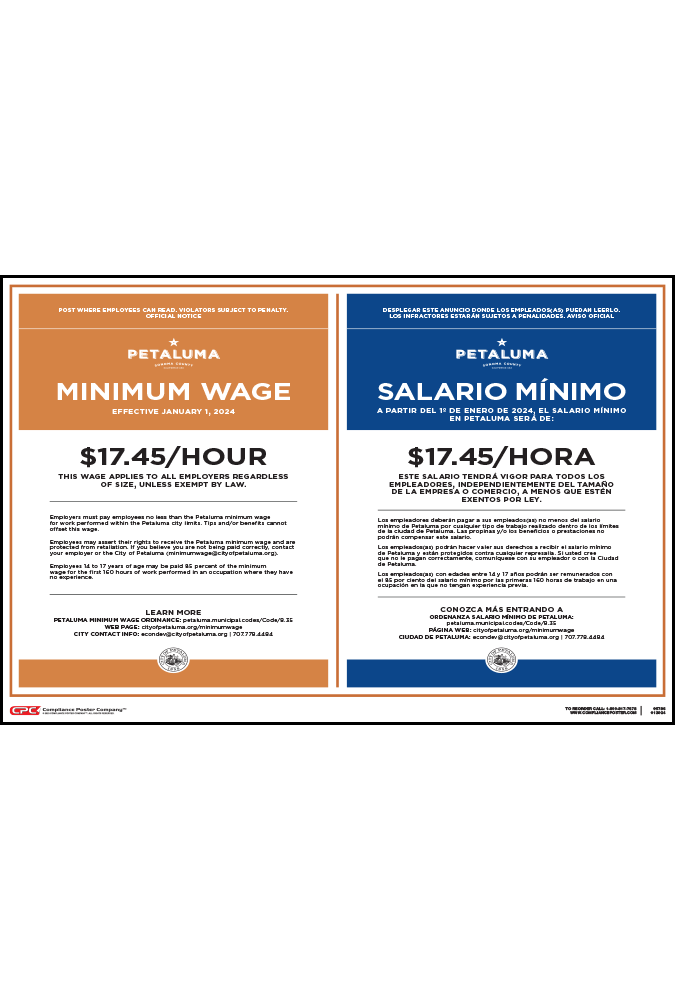

All employers with employees who perform at least least 2 hours per week within city boundaries of the City of Petaluma, CA must conspicuously post the Annual Notice of Employee Rights informing employees of the applicable minimum wage rate each year. The notice must be posted in English, Spanish and other language required by administrative regulations.

How is the applicable minimum wage rate determined?

- Beginning January 1, 2021, and annually thereafter, the minimum wage all employers must pay to employees (except as otherwise provided in this section), regardless of the number of employees each employer employs, will be adjusted based on the Consumer Price Index for the region.

- Starting January 1, 2025, the Petaluma minimum wage rate will be $17.97/hour for all employers regardless of size.

- The Petaluma Minimum Wage Ordinance allows employers to pay a wage of $15.30 to workers who are 14 to 17 years of age, for the first 160 hours of employment.

Who is covered by the Petaluma Minimum Wage Ordinance?

- The Ordinance covers all employees who work at least 2 hours per week within City limits and who qualify for the minimum wage according to the California Labor Code.

- The Ordinance does not apply to Federal, State, or County agencies, including school districts.

- It also does not apply to work done outside the Petaluma City limits or to time an employee spends travelling through the city to get to another destination.

What are the law’s protections and penalties?

An employer may not discriminate against any employee for exercising his or her rights under the ordinance. Either the City or an employee may take legal action against an employer for violations of the law. Remedies include back wages unlawfully withheld plus interest, and payment of an additional sum as a civil penalty in the amount of $50.00 per employee per day.

What are the notice and recordkeeping requirements?

In addition to posting the required annual minimum wage notice, an employer must give to each new employee within one week of the start of employment an Initial Notice of Employee Rights. The notice must be provided in each language spoken by 10% of the employees, and conspicuously posted in the workplace.

Employers are required to maintain a record of each employee’ s name, his or her hours worked, and pay rate for a period of three years. Employers provide each employee, upon hiring and annually, written notice including the employer’ s legal name, address, telephone number, and the person to contact regarding compliance with the law.