Who must post the Redwood City, CA Minimum Wage Poster?

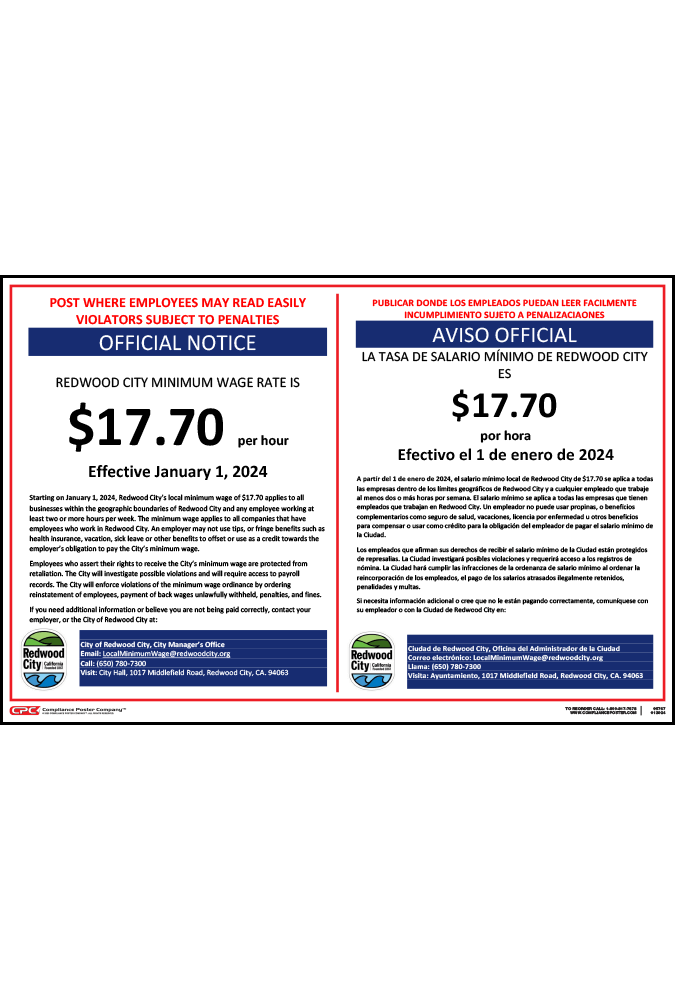

Beginning on January 1, 2019, and each year thereafter, employers with employees who work in Redwood City are required to post the official Redwood City, CA Minimum Wage Poster in the workplace to inform employees of the effective minimum wage rate and their rights under the City’s Minimum Wage Ordinance. The Ordinance applies to any employee who performs at least two hours’ work per week within City limits and who is also covered by California’s Minimum Wage Law.

How is the minimum wage rate determined?

Redwood City’s minimum wage rate is adjusted annually for inflation by an amount corresponding to the increase in the Consumer Price Index (CPI). The minimum wage rate will not decrease if there is a decrease in the CPI. The City announces the following year’s minimum wage rate in November of each year.

Do employees’ tips count toward the minimum wage rate?

No. Employees’ tips belong to the employee and do not count toward the employer’s obligation to pay the minimum wage rate. An employer may not use fringe benefits, such as health insurance, vacation or sick leave, to offset the minimum wage requirement.

What else is required?

- Employers must inform new hires with the employer’s name, address and telephone number in writing

- Employers retain payroll records for three years

- Employers may not discriminate or take adverse action against any person in retaliation for exercising rights protected under the law

- An employee or the City may institute a civil action for violations. The City may pursue administrative penalties.