Richmond, CA Minimum Wage Pay and Posting Requirements

- Under the Richmond’s Minimum Wage Ordinance, employers must pay employees no less than the effective Minimum Wage for each hour worked within the geographic boundaries of the City of Richmond.

- Employers may deduct a specified amount from the the minimum hourly wage rate if they pay at least the specified amount for the employee’s medical benefits plan.

- Employers that provide goods and services outside of the City of Richmond and meet certain requirements of the law may pay its employees an Intermediate Minimum Wage described in the Notice.

- Beginning January 1, 2019, the City’s minimum wage rate is adjusted for inflation every January 1, based on the Consumer Price Index.

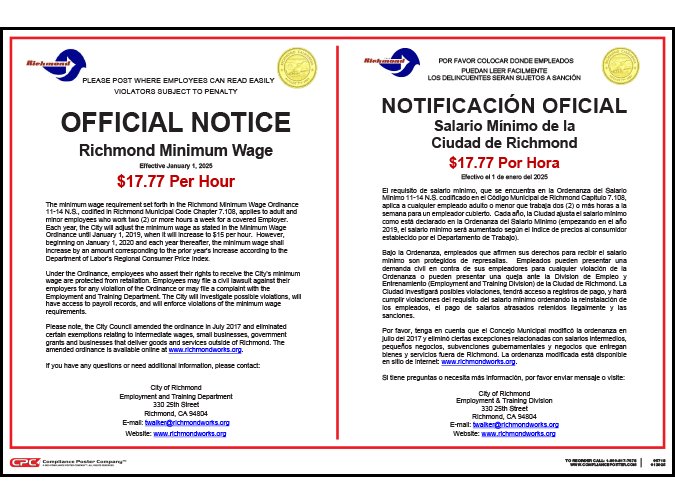

- Every employer must post the notice published each year by the City of Richmond in a conspicuous place at any workplace or job site where any employee works informing employees of the current Minimum Wage rate and of their rights under this ordinance.

Enforcement

The prohibits an employer from retaliating against an employee for making a compliant to the City or for exercising civil remedies to enforce his or her rights. Employers are subject to civil penalties for violations of the law. City contact information is provided on the Minimum Wage Notice.

Notice & Recordkeeping

- Employers must post the City’s official Minimum Wage Notice.

- The Notice must be posted in all languages spoken by more than five percent (5%) of the employees.

- Employers are also required to maintain payroll records for a period of four (4) years.