Employers – it’s time to prepare your OSHA Form 300A, Summary of Work-Related Injuries and Illnesses! The OSHA Form 300A Posting Deadline is February 1

Employers – it’s time to prepare your OSHA Form 300A, Summary of Work-Related Injuries and Illnesses! The OSHA Form 300A Posting Deadline is February 1

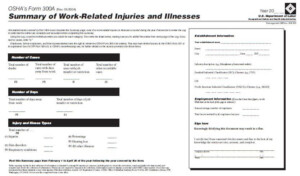

Each February 1, the Occupational Safety and Health Administration (OSHA) requires employers to post in the workplace OSHA Form 300A, which lists a summary of the total number of job-related injuries and illnesses from the previous year. Information from the Form 300A helps employers, workers and OSHA evaluate the safety of a workplace, understand industry hazards, and implement worker protections to reduce and eliminate hazards preventing future workplace injuries and illnesses. This February 1, employers must post a Form 300A summarizing injuries and illnesses that occurred in 2017. OSHA injury and illness recordkeeping forms can be downloaded here.

When preparing the Form 300A for your establishment, here are some things to remember:

- Form 300A must be posted between Feb. 1 and April 30, 2018. At the end of the three-month posting period, the Form 300A may be taken down but the form must be kept on file for a period of five years.

- Form 300A requires employers to transfer from Form 300, Log of Work-Related injuries and Illnesses the total number of cases, number of days away from work, number of days requiring job transfer or restriction, injury and illness types, and complete establishment information, including the total number of employees and total hours worked by employees.

- Form 300A must be posted even if no work-related injuries or illnesses occurred during the recorded year. If the business had no recordable cases, zeros should be entered in column totals.

- A company executive must certify that he or she has examined the OSHA Form 300 log and that the annual Form 300A summary is accurate and complete, to the best of his or her knowledge. Company executives that may certify the form include:

- An owner of the company

- An officer of the corporation

- The highest-ranking company official working at the site

- The immediate supervisor of the highest-ranking company official working at the site

- The completed Form 300A should be displayed in a common area where notices to employees are usually posted so that employees are aware of the injuries and illnesses occurring in the workplace. Posting Form 300A electronically does not satisfy OSHA’s posting requirements.

- Companies with several locations must post a separate Form 300A for each location that is expected to be in operation for one year or longer.

State-Plan Form 300A Posting

OSHA covers most private sector employers and workers either directly or through an OSHA-approved “State Plan.” Twenty-six states, Puerto Rico, and the Virgin Islands have OSHA-approved State Plans. Employers in State Plan states are required to post summary injury and illness data on Form 300A or an equivalent record between February 1 and April 30 of each year. Most State Plans use federal OSHA Form 300A for this purpose. However, some states have their own nearly identical version of the Form 300A annual summary. Employers should check with their State Plan administrator to seem if the form differs in their state. State Plan contact information is available here.

Businesses Exempted Form 300A Posting Requirements

There are two exemptions to the Form 300A posting requirement – employers with 10 or fewer employees in the entire company and certain low hazard industries. First, employers with ten or fewer employees at all times during the previous calendar year, regardless of the industry classification, are exempt from routinely keeping OSHA injury and illness records.

Second, establishments in certain low-hazard industries are also partially exempt from routinely keeping OSHA injury and illness records. In 2015, OSHA changed the industries covered by this exemption so it’s important for employers to determine whether they are still able to claim this exemption. Currently, OSHA uses the North American Industry Classification System (NAICS) codes to identify the exempt industries. To find out if your business is exempt, you can use the NAICS webpage to determine your NAICS code. Check your code number against Table 1 here to see if your business qualifies for an exemption.

Typically, low hazard businesses include:

- Certain retail stores

- Eating and drinking places

- Finance, insurance, and real estate agencies

- Certain service industries (personal and business services, medical and dental offices, and legal, educational, and membership organizations)

Employers in State Plan states should check with their state program administrator for current exemption rules. Employers can view current State Plan adoption of federal OSHA reporting requirements here.

Electronic Reporting of Form 300A Data

In addition to posting Form 300A in the workplace, OSHA requires some employers to report Form 300A injury and illness data to OSHA electronically. OSHA has established a website where employers have different options for data submission – manual entry into a webform, uploading a CSV file or using an API (application programming interface). The Injury Tracking Application (ITA) is accessible from the ITA launch page, where employers can provide OSHA Form 300A information to OSHA.

In 2018, establishments with 250 or more employees and establishments with 20-249 employees in certain high-risk industries listed here must submit information from their 2017 Form 300A by July 1, 2018. Beginning in 2019 and every year thereafter, covered establishments must submit Form 300A information by March 2.

The following OSHA-approved State Plans have not yet adopted the requirement to submit injury and illness reports electronically: California, Maryland, Minnesota, South Carolina, Utah, Washington, and Wyoming. Establishments in these states are not currently required to submit their summary data through the ITA. Similarly, state and local government establishments in Illinois, Maine, New Jersey, and New York are not currently required to submit their data through the ITA.

Remember, safety in the workplace prevents injuries and illnesses and reduces your recording and reporting burden.