It has been 10 years since Illinois has implemented a minimum wage rate increase. This year, Illinois’ low wage workers will start earning higher wages beginning with a $2 bump in their hourly wage rate to $9.25 per hour on January 1, 2020 and quickly followed by another 75₵ increase in July. The boost in the minimum wage rate was propelled by the grassroots “Fight for Fifteen” campaign which led Illinois lawmakers to enact 2019 Senate Bill 1, raising the state’s minimum wage rate incrementally over the next seven years until it reaches $15.00 per hour in 2025.

It has been 10 years since Illinois has implemented a minimum wage rate increase. This year, Illinois’ low wage workers will start earning higher wages beginning with a $2 bump in their hourly wage rate to $9.25 per hour on January 1, 2020 and quickly followed by another 75₵ increase in July. The boost in the minimum wage rate was propelled by the grassroots “Fight for Fifteen” campaign which led Illinois lawmakers to enact 2019 Senate Bill 1, raising the state’s minimum wage rate incrementally over the next seven years until it reaches $15.00 per hour in 2025.

Minimum Wage Rates Around the Nation

Illinois is not the only state to schedule minimum wage rate increases each year until they reach $15.00 per hour. Similar laws have taken effect in Connecticut, California, Massachusetts, Maryland, New Jersey, New York and the District of Columbia. This year, minimum wage rates will also increase in states that index minimum wage increases to the annual rate of inflation. Several states have adopted lesser one-time minimum wage increases this year. In total, twenty-four states and Washington, D.C. will implement increases their minimum wage rates this year.

Illinois’ Scheduled Minimum Wage Increases

Illinois’ minimum wage rate will increase as follows:

- $9.25 per hour – January 1, 2020 through June 30, 2020

- $10.00 per hour – July 1, 2020 through December 31, 2020

- $11.00 per hour – January 1, 2021 through December 31, 2021

- $12.00 per hour – January 1, 2022 through December 31, 2022

- $13.00 per hour – January 1, 2023 through December 31, 2023

- $14.00 per hour – January 1, 2024 through December 31, 2024

- $15.00 per hour – on and after January 1, 2025

The law establishes a separate schedule for new employees who are under 18 years of age.

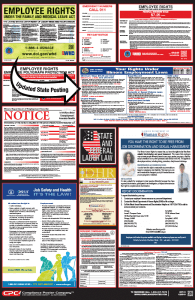

Updated Illinois Employee Rights Poster

Illinois’ newly revised Your Rights Under Illinois Employment Laws notice features the January 1, 2020 minimum wage rate and shows the future minimum wage rate increases. In addition, the notice contains information about legislative changes from previous years, including:

- 2019 House Bill 834 – banning employers from asking applicants’ histories but permitting employees to discuss their current or prior wages with their coworkers.

- 2018 House Bill 4743 – providing that an employer may not pay an African American employee less than a non-African American employee for the same or substantially similar work.

- 2018 Senate Bill 2999 – requiring employers to reimburse employees for all necessary expenses or losses incurred by such employees during the scope of employment. Reimbursement requests must be submitted within 30 days, unless the employer permits a longer period.

- 2016 House Bill 1288 – expanding the Minimum Wage Law to cover domestic workers, even if the employer has only one worker.

Posting Compliance and Enforcement

Employers covered by the provisions of any of the six major labor laws referenced on the Illinois Department of Labor’s Your Rights Under Illinois Employment Laws notice must post the revised notice. Employers can comply with the posting requirement by purchasing the 2020 Illinois All-On-One Labor Law Poster™ or using the Your Rights Under Illinois Employment Laws Peel ‘N Post™ stickers to update existing Illinois All-On-One Posters. Employers should also be prepared to update posters again before the next the minimum wage rate goes into effect on July 1, 2020.

Protect your business from the consequences of failing to comply. Failure to post the notice is a Class B misdemeanor and each day an employer fails to post the notice is treated as a separate offense. (820 ILCS 105/9) In Illinois, a Class B misdemeanor carries a maximum penalty of up to 6 months in jail and a fine of up to $1,500.

|

|