In order to provide you with the most up-to-date postings, this item has been placed on hold pending a mandatory change. Should you need this item for an inspection or other immediate need, please call CPC at (800) 817-7678 to have the item shipped immediately. Otherwise, orders for this item will ship as soon as the update becomes available.

Who must post the Sonoma, CA Minimum Wage Poster?

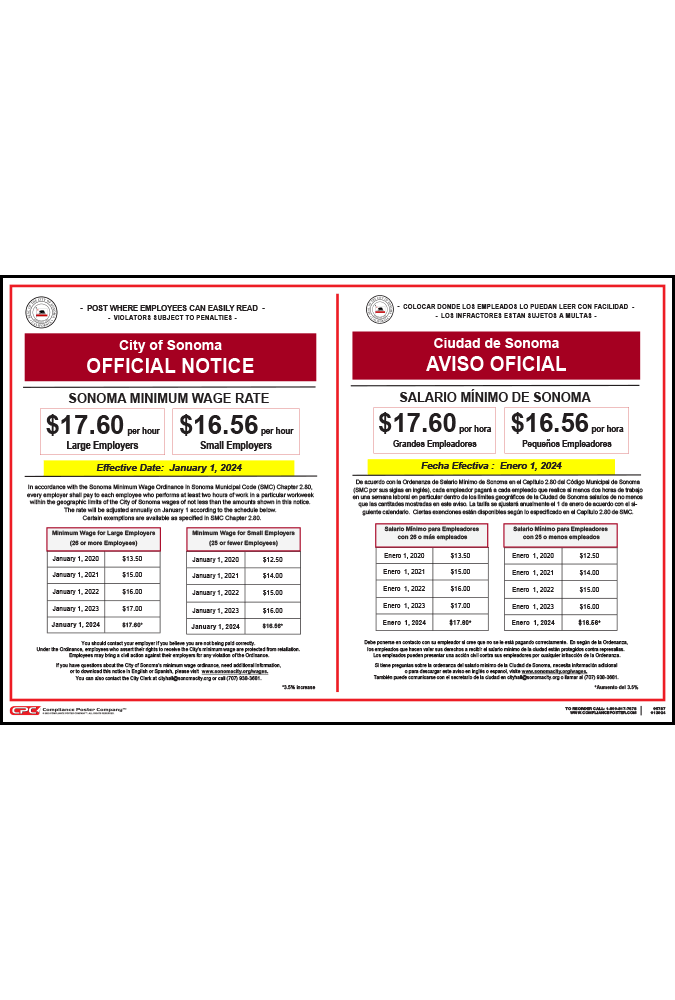

All employers with employees who perform more than two (2) hours of work per week within the geographic boundaries of the City of Sonoma are required to post the Sonoma, CA Minimum Wage Poster. The Poster reflects the effective and scheduled minimum wage rate increases and informs employee’s of their rights under the law.

What are the City’s scheduled minimum wage rates?

The effective minimum wage rate is determined by employer size. The scheduled minimum wage rates are:

Large employers (26 or more employees)

- January 1, 2020 – $13.50 per hour

- January 1, 2021 – $15.00 per hour

- January 1, 2022 – $16.00 per hour

- January 1, 2023 – $17.00 per hour

- January 1, 2024 – $17.00 + CPI up to 3.5%,

Small employers (25 or fewer employees)

- January 1, 2020 – $12.50 per hour

- January 1, 2021 – $14.00 per hour

- January 1, 2022 – $15.00 per hour

- January 1, 2023 – $16.00 per hour

- January 1, 2024 – $16.00 + CPI up to 3.5%

In general, an employer may not use a tipped employee’s tips toward its minimum wage obligation.

How is employer size determined?

In determining the number of persons performing work for an employer during a given week, all persons performing work for the same business enterprise, including full-time, part-time, or temporary workers, are counted, regardless of whether the employees work inside of or outside of the City.

What are the law’s protections and penalties?

An employer may not discriminate or retaliate against any employee for exercising his or her rights under the ordinance. Remedies include reinstatement, and the payment of back wages unlawfully withheld, and a civil penalty in the amount of one hundred dollars ($100.00) to each employee whose rights were violated for each day that the violation occurred or continued.

What are the notice and recordkeeping requirements?

Every employer is required to post in a conspicuous place at any workplace or job site where any covered employee works a notice informing employees of the adjusted minimum wage rate for the upcoming 12-month period and their rights under law. The notice must be posting in English, Spanish and other languages, if required by implementing regulations. Employers must give written notification to each current and new employee of his or her rights under law. The notification shall be in all languages spoken by more than 10% of the employees and shall also be posted prominently in areas at the work site where it will be seen by all employees.

Every employer must maintain for at least (3) three years a record of each employee’s name, hours worked, and pay rate and must be provided to the employee upon reasonable request. Every employer must provide each employee, upon hire and annually, with a written notification setting forth the employer’s legal name, address, and telephone number, and the name of a person responsible for inquiries concerning compliance with the ordinance.