In order to provide you with the most up-to-date postings, this item has been placed on hold pending a mandatory change. Should you need this item for an inspection or other immediate need, please call CPC at (800) 817-7678 to have the item shipped immediately. Otherwise, orders for this item will ship as soon as the update becomes available.

Who must post the Howard County, MD Minimum Wage Poster?

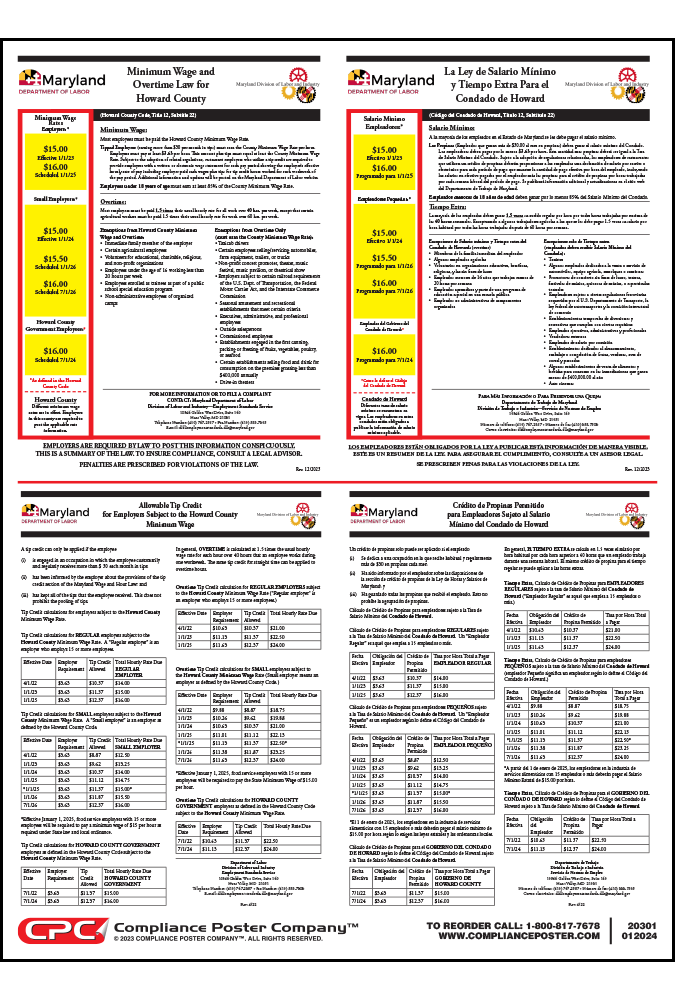

All employers operating and doing business in Howard County, MD, with one or more employees instructed or permitted to work or be present in the County, must post the Howard County, MD Minimum Wage Poster in the workplace.

What does the Howard County, MD Minimum Wage Poster cover?

Howard County Code (HCC §12.2200 et seq.) requires all Howard County employers to pay employees at least the applicable minimum wage rate for work performed within the County.

The poster provides the applicable minimum wage rates effective minimum wage rate and future scheduled minimum wage rates for:

- Large employers – employers with 15 or more employees

- Small employers – employers with 14 or fewer employees – and non-profits

- Howard County government employees

Beginning January 1, 2027, the minimum wage rate will be adjusted based on the Consumer Price Index.

The poster also covers:

- The Howard County tipped employee minimum wage rate

- Calculations for tip credits allowed for large employers, small employers, and Howard County government employers for each year

- Employees exempt from minimum wage and overtime

- Employees exempt from overtime only

How is the law enforced?

The law is enforced by the Maryland Department of Labor (MDOL). Employees who believe they are not being paid the applicable minimum wage rate may file a complaint with the MDOL. Contact information for the MDOL is provided.