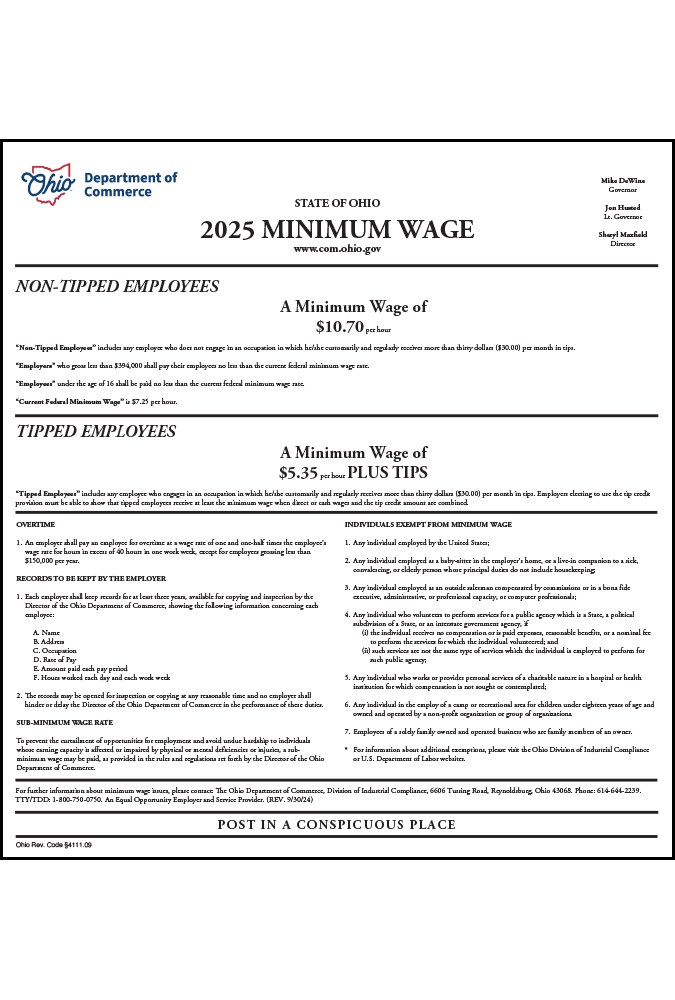

Who must post the 2025 Ohio Minimum Wage Peel ‘N Post?

Every Ohio employer subject to the Ohio Minimum Wage Law and implementing rules must display the official 2025 Minimum Wage posting posted in a conspicuous and accessible place on the employer’s premises where any covered employee works. (ORC § 4111.09)

What’s new?

2025 Ohio Minimum Wages and Employer Income Adjustments:

| General Minimum Wage Rate | $10.70 per hour |

| Tipped Employee Minimum Wage | $5.35 per hour plus tips |

| Employer Income Threshold | $394,000 |

How is the Ohio minimum wage rate calculated?

- The Ohio Constitution requires that the State minimum wage rate be adjusted for inflation each January 1. The increase is calculated using the percentage the Consumer Price Index (CPI) increased over the previous year, rounded to the nearest five cents.

- An employer may pay a tipped employee no less than the half the general minimum wage rate if the employer can show that the employee’s combined tips and cash wages are at least equal to the general minimum wage rate.

- Employees under the age of 16 and employees of businesses that grossed less than $394,000 for the preceding year must be paid at least the $7.25/hour federal minimum wage rate. The gross revenue figure is increased each year by the change in the CPI, rounded to the nearest one thousand dollars.