San Francisco Paid Parental Leave & Health Care Security Poster Updates Required

Historically, San Francisco has been proactive in ensuring that employees who work in San Francisco receive certain benefits they might not otherwise obtain from their employers. Two of these benefits are paid leave for new parents and employer-paid health care. Beginning January 1, 2018, these benefits will reach more employees and require employers to dig a little deeper into their pockets to provide employees with stable incomes and access to health care.

Paid Parental Leave Benefits Reach More Employees in 2018

Paid Parental Leave Benefits Reach More Employees in 2018

The San Francisco Paid Parental Leave Ordinance (PPLO) requires employers to provide “Supplemental Compensation” to covered employees who are receiving California Paid Family Leave (PFL) benefits to bond with a newborn, newly adopted or foster child, so that employees receive 100% of their normal weekly wages during the 6-week leave period. An employee who works at least 8 hours per week and 40% of their weekly hours within City limits for a covered employer is eligible for PPLO Supplemental Compensation. An employer is covered if it employs a certain number of employees, as described below.

The Supplemental Compensation rate is equal to the difference between the employee’s state PFL benefit amount and the employee’s normal gross weekly wages. Together, PFL and PPLO wage replacement benefits equal 100% of the employee’s gross weekly wage. Currently, California PFL pays 55% of an employee’s weekly wage and employers must pay the remaining 45%. Beginning January 1, 2018, state PFL benefits will increase to 60%, and in some cases 70%, of the employee’s weekly wages. Employers will pay the remaining 40% (or 30%) of the employee’s wages.

Although the 2018 increase in state PFL benefits reduces the amount of Supplemental Compensation employers must pay, more employers will be covered the PPLO next year. In 2017, the threshold number of employees that an employer must employ went from 50 employees down to 35 employees, regardless of their work location. Beginning January 1, 2018, the PPLO applies to employers with 20 or more employees wherever located.

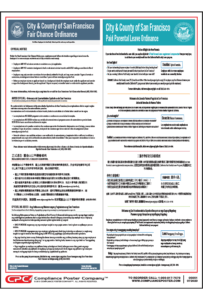

Employers with 20 or more employees are required to post the City’s 2018 PPLO posting where any covered employee works, in English, Spanish, Chinese and any other language spoken by at least 5% of the employees at the workplace or job site. CPC has combined the 2018 PPLO posting with other San Francisco workplace postings required for employers of this size. Each of the required languages are reflected on this poster.

Employer Health Care Security Ordinance Contribution Rates Increase in 2018

Employer Health Care Security Ordinance Contribution Rates Increase in 2018

San Francisco’s Health Care Security Ordinance (HCSO) is a law that requires employers that engage in business within the City of San Francisco to make health care-related expenditures on behalf of their employees who work in the City. Specifically, the law applies to:

- Covered employers – An employer that (1) employs one or more workers within the geographic boundaries of the City of San Francisco, (2) is required to obtain a valid San Francisco business registration certificate, and (3) is a for-profit business with 20 or more employees, or a nonprofit employer with 50 or more employees, regardless of their location.

- Covered employees – An employee who works for a covered employer, has been employed for more than 90 days and who works at least 8 hours per week in the City of San Francisco.

A health care expenditure (HCE) is any amount paid by a covered employer to its covered employees, or to a third party on behalf of its covered employees, for the purpose of providing health care services to, or reimbursing the cost of such services for, covered employees. Each year, the City sets an amount that must be contributed to health care for employees for each hour that the employee works within City limits. Beginning January 1, 2018, the health care expenditure rate is $2.83 per hour for large businesses (100 or more employees total) and $1.89 per hour for medium-sized businesses (20-99 employees total).

Employers choose how to make the required health care expenditures for their covered employees, but as of January 1, 2017, only irrevocable expenditures count toward the employer spending requirement. Common expenditures include:

- Payments for health, dental, and/or vision insurance;

- Payments to the City’s public benefit program referred to as the “City Option;” and

- Contributions to programs that reimburse employees for out-of-pocket health care costs

Employers with 20 or more employees are required to post the 2018 HCSO workplace posting in English, Spanish, Chinese and any other language spoken by at least 5% of the employees at the workplace or job site. CPC has combined the 2018 HCSO Notice in each language with other San Francisco workplace postings required for employers of this size.

To order, click on the images above or on one of the following links:

San Francisco Fair Chance & Paid Parental Leave Ordinance Poster

San Francisco Family Friendly Workplace & Health Care Security Ordinance Poster