What’s New?

What’s New?

This year, Nevada passed legislation (Senate Bill 493) that will enable the state to more aggressively identify and deter the practice of misclassifying workers as independent contractors. Updating the Nevada Workers’ Compensation Informational Poster to explain the terms “employer,” “employee” and “independent contractor” is one preventive measure. The law also calls upon the the public and private sector to work together to address the problem:

- The law requires the Labor Commissioner, the Division of Industrial Relations, the Employment Security Division, the Department of Taxation and the Attorney General to share information related to suspected employee misclassification; and

- The law creates a task force from among private employers, union representatives, independent contractors, trade associations and government agencies to evaluate and make recommendations for administrative and legislative changes to reduce the occurrence of employee misclassification.

Employee Misclassification Touch Up

Senate Bill 493 provides additional direction regarding classification prohibitions and presumptions. The law defines “employee misclassification” as the practice by an employer of improperly classifying employees as independent contractors to avoid any legal obligation under state labor, employment and tax laws, including, the laws governing minimum wage, overtime, unemployment insurance, workers’ compensation insurance, temporary disability insurance, wage payment and payroll taxes.

Under the law, an employer may not:

- through means of coercion, misrepresentation or fraud, require a person to be classified as an independent contractor or form any business entity in order to classify the person as an independent contractor; or

- willfully misclassify or otherwise willfully fail to properly classify a person as an independent contractor.

The law creates a presumption that a contractor or subcontractor is an independent contractor if:

- the person holds a state or local business license to operate in Nevada;

- the person is free from control or direction in performing the service;

- the service is outside the usual course of the business for which the service is performed, or the service is performed away from the business; and

- the service is part of an independently established trade, occupation, profession or business in which the person is customarily engaged.

What are the Penalties for Misclassification?

The penalties for misclassification are steep. For the first offense, an employer who unintentionally misclassifies a worker as an independent contractor will receive a warning. For a first offense, an employer who willfully misclassifies a worker as an independent contractor is subject to a penalty of $2,500. For each subsequent offense of willful misclassification, an employer is subject to a fine of $5,000. An employer is also subject to damages such as lost wages, benefits or other economic damages.

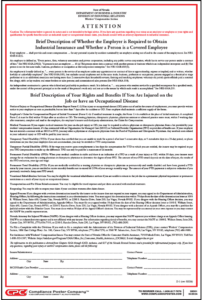

What are the Latest Changes to the Nevada Workers’ Compensation Informational Poster?

Senate Bill 493 requires that the Nevada Workers’ Compensation Informational Poster prominently set forth the applicable definitions of “employee” and “independent contractor,” as those terms are defined in the Nevada Industrial Insurance Act.

The updated Nevada Workers’ Compensation Informational Poster includes:

- the statutory definition of “employer” (NRS 616A.230) as well as individuals who are not included within the definition;

- the statutory definition of “employee” (NRS 616A.105) and individuals who are excluded from the definition; and

- the statutory definition of “independent contractor.” (NRS 616A.255).

Employees who have questions about their status or qualification for benefits are advised to consult with an attorney. The posting incorporates the new web and email address of the Office for Consumer Health Assistance. The posting date is 11/19.

What are the Penalties for Failure to Post the Nevada Workers’ Compensation Informational Poster?

Any employer who fails to post the notice required by NRS 616A.490 in a place that is readily accessible and visible to employees is guilty of a misdemeanor. (NRS 616D.270).

|

|