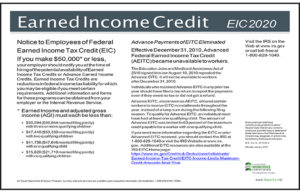

Just in time for the 2020 tax season, the Louisiana Workforce Commission (LWC) has released both the 2019 Earned Income Credit (EIC) Notice and the 2020 EIC Notice that Louisiana employers are required to post in the workplace each year to advise their employees that they may be eligible for the federal Earned Income Tax Credit (EITC). Workers will find the information useful in preparing this year’s tax returns and planning for next year’s tax obligations.

What is the EITC?

The EITC is a tax credit available to employees with modest incomes. EITC reduces the amount of tax that an employee owes and may give the employee a refund. Employees who earn less than the amounts stated in Louisiana’s annual EIC Notice may qualify for the tax credit. The value of the credit to each employee depends factors such as the employee’s income, filing status and whether the employee has any qualifying children.

What does the EIC Notice cover?

The EIC Notice informs new employees whose anticipated income is less than the amount stated on the notice that their employer must notify them of the potential availability of the tax credit at the time of hiring. The EIC Notice also provides the maximum income an employee can earn to be eligible for the tax credit based on the number of qualifying children the employee has and whether the employee is married filing jointly. The income limits stated in the 2019 EIC Notice are based on income earned in 2019. The income limits stated in the 2020 EIC Notice are based on income earned this year. EIC Notices also explain that employees are no longer able to receive “Advance EITC” installments prior to filing their annual tax return.

Which EIC Notice should Louisiana employers post?

The law requires the LWC to update its EIC Notice every year for posting by employers. Presently, the LWC requires employers to post the 2020 EIC Notice which specifies the IRS’s current income eligibility rates. For some reason, the 2019 EIC Notice was not made available for posting last year. However, the 2019 EIC Notice is relevant to income tax returns that must be filed by April 15, 2020. To ensure employees are informed of EITC income eligibility rates for tax preparation and planning purposes, employers should post the 2020 EIC Notice throughout the year and post the 2019 EIC Notice from now until April 1,5, 2020.

Next steps:

- Post the new 2020 Louisiana All-On-One™ Poster which includes the 2020 EIC Notice, or

- Use the 2020 EIC Notice Peel ‘N Post™ to update your existing Louisiana All-On-One Poster, and

- Post our free 2019 EIC Notice next to your updated Louisiana All-On-One Poster until April 15th.

More information about the EITC can be found on the IRS’s website here.

|

|