Working together to protect employees in light of the Coronavirus (COVID-19) public health emergency, the U.S. Congress and President Donald Trump took swift legislative action this month to enable employees to care for afflicted family members, themselves and their children without fear of losing their jobs or financial stability. On March 18, 2020, the Families First Coronavirus Response Act (FFCRA) (HB 6201) was signed into law granting paid sick leave to employees if they or a family member contracts the disease and expanding parents’ family and medical leave rights to include partially paid leave to care for a child who is home because their school or daycare provider closed in response to the outbreak. The FFCRA goes into effect on April 1, 2020 and lasts until December 31, 2020. All federal employers and private- and public-sector employers with fewer than 500 employees are required to post the Families First Coronavirus Response Act Poster.

Working together to protect employees in light of the Coronavirus (COVID-19) public health emergency, the U.S. Congress and President Donald Trump took swift legislative action this month to enable employees to care for afflicted family members, themselves and their children without fear of losing their jobs or financial stability. On March 18, 2020, the Families First Coronavirus Response Act (FFCRA) (HB 6201) was signed into law granting paid sick leave to employees if they or a family member contracts the disease and expanding parents’ family and medical leave rights to include partially paid leave to care for a child who is home because their school or daycare provider closed in response to the outbreak. The FFCRA goes into effect on April 1, 2020 and lasts until December 31, 2020. All federal employers and private- and public-sector employers with fewer than 500 employees are required to post the Families First Coronavirus Response Act Poster.

Emergency Paid Sick Leave Act (PSLA)

The PSLA provisions of the FFCRA require private employers with fewer than 500 employees, and all public sector employers, to provide two weeks (80 hours) of paid sick leave to an employee if the employee is unable to work (or telework) because the employee:

|

QUALIFYING REASONS |

| 1. is subject to a Federal, State or local quarantine or isolation order related to COVID-19; |

| 2. has been advised by a health care provider to self-quarantine due to COVID-19 related concerns; |

| 3. is experiencing symptoms of COVID-19 and is seeking a medical diagnosis; |

| 4. is caring for an individual who is subject to an isolation order or who has been advised to self-quarantine; |

| 5. is caring for a child whose school or place of care is closed or unavailable for reasons related to COVID-19; or |

| 6. is experiencing any other substantially similar condition specified by the U.S. Department of Health and Human Services. |

Part-time employees receive paid sick leave based on the number of hours the employee works on average over a 2-week period.

PSLA benefits are calculated based on the higher of the employee’s regular wage rate or the applicable minimum wage rate, paid at a rate of:

- 100% for qualifying reasons #1-3, up to $511/day and $5,110 in total; and

- 2/3 for qualifying reasons #4-6, up to $200/day and $2,000 in total.

An employer may not require an employee to use other paid leave provided by the employer before the employee can use the emergency paid sick leave.

Emergency Family and Medical Leave Expansion Act (EFMLA)

EFMLA expands leave under the Family and Medical Leave Act (FMLA) for employees who need to care for their child whose school or childcare facility has been closed due to the COVID-19 health emergency. EFMLA provisions apply to both full- and part-time employees of private employers with fewer than 500 employees and certain public employers. EFMLA applies to employees of the federal government who are covered by Title I of the FMLA. However, most federal employees are covered by Title II of the FMLA, which was not amended by the FFCRA, and are therefore not covered by expanded family and medical leave provisions of the Act. All federal employees are covered by the paid sick leave provisions described above.

To be eligible for EFMLA, employees must have worked for a covered employer for at least 30 calendar days. The law allows employees to take up to 12 weeks of job-protected leave to care for a child displaced due to the COVID-19 outbreak. The first two weeks of expanded family and medical leave is unpaid, but an employee may substitute PSLA, vacation or any other paid leave during this period. After two weeks, an employer must provide up to 10 weeks of leave paid at a rate of 2/3 of the employee’s regular rate, or the applicable minimum wage rate, whichever is higher. EFMLA benefits are capped at $200/day or $10,000 in the aggregate. If the employee uses two-week PSLA followed by 10 weeks of EFMLA, benefits are capped at $12,000.

Upon return from EFMLA, the employer must restore the employee to the same or an equivalent position held by the employee prior to the leave. Under certain conditions, employers with fewer than 25 employees may be relieved of this requirement if they can show that compliance would cause economic hardship.

Tax Credits and Exemption

- Covered employers qualify for dollar-for-dollar reimbursement through tax credits for all qualifying wages paid under the FFCRA. Qualifying wages are those paid to an employee who takes leave under the Act for a qualifying reason, up to the appropriate per diem and aggregate payment caps. Applicable tax credits also extend to amounts paid or incurred to maintain health insurance coverage.

- Employers with fewer than 50 workers can apply for an exemption from the requirement to provide leave due to a school closing or childcare provider unavailability if the leave requirements would jeopardize the viability of the business.

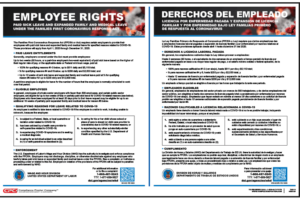

FFCRA Posting Requirement

All covered employers must post the U.S. Department of Labor’s (DOL) FFCRA notice in a conspicuous place on its premises. An employer may satisfy this requirement by emailing or direct mailing the FFCRA notice to employees or posting the FFCRA notice electronically on an employee internal or external website. The DOL has created two FFCRA notices, one for federal agencies and one for all other employers. Although employers are only required to post the FFCRA notice in English, for bilingual workplaces, Compliance Poster Company has also created bilingual English/Spanish posters.

- Employee Rights under the Families First Coronavirus Response Act – English

- Employee Rights under the Families First Coronavirus Response Act – Bilingual

- Federal Employee Rights under the Families First Coronavirus Response Act – English

- Federal Employee Rights under the Families First Coronavirus Response Act – Bilingual

The DOL has emphasized that the FFRCA notice must be posted where employees can see it. The DOL’s guidance explains that if employees start their workday at a remote worksite or they report to work on different floors or to different buildings without first reporting to work at a central location, then the FFCRA notice must be posted in each of these remote work locations.

Enforcement

Employers may not discharge, discipline, or otherwise discriminate against any employee who takes paid sick leave under the FFCRA and files a complaint or institutes a proceeding under or related to the FFCRA. Employers in violation of the FFCRA are subject to the penalties and enforcement provisions of the Fair Labor Standards Act and the Family and Medical Leave Act. The DOL will observe a temporary period of non-enforcement through April 17, 2020, so long as the employer has acted reasonably and in good faith to comply with the Act. The DOL has indicated it will issue implementing regulations in April 2020.

|

|