Employers within the geographic bounds of Saint Paul, MN can comply with the Minimum Wage and Earned Sick and Safe Time Ordinance notice requirements by posting this poster in the workplace.

On November 15, 2018, the Mayor of Saint Paul, MN signed an ordinance which institutes a municipal minimum wage for the City. The ordinance sets different rates for the city government and for private employers depending on the number of employees.

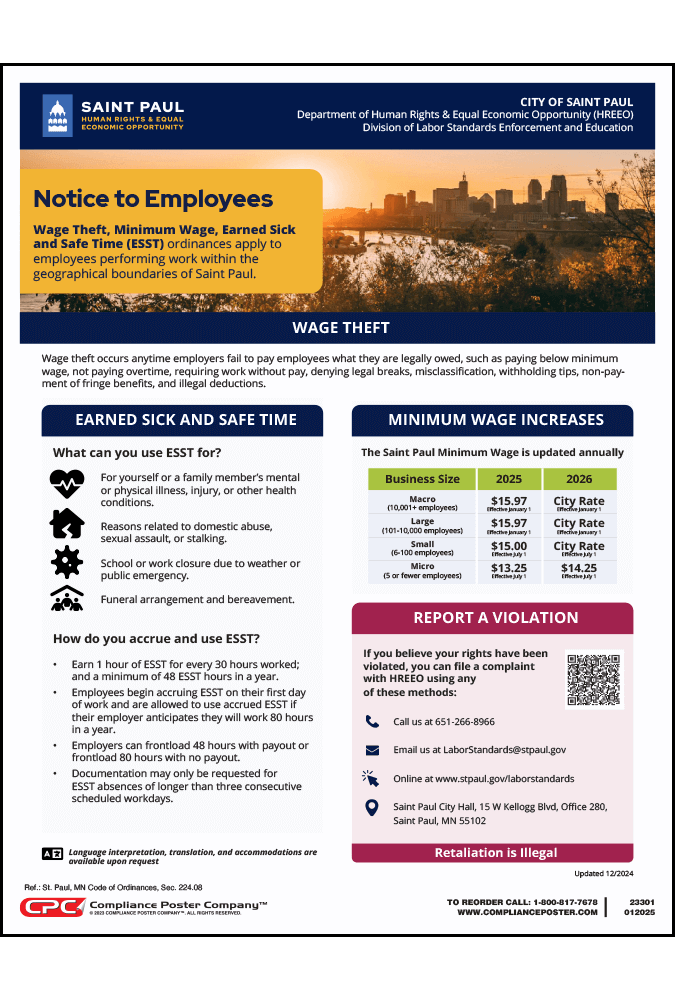

| Date | Macro* | Large* | Small* | Micro* |

| 2022 | $ 15.00 | $ 13.50 | $ 12.00 | $ 10.75 |

| 2023 | $15.19 | $ 15.00 | $ 13.00 | $ 11.50 |

| 2024 | $15.57 | $15.57 | $ 14.00 | $ 12.25 |

| 2025 | 15.97 | 15.97 | $ 15.00 | $ 13.25 |

| 2026 | City Rate | City Rate | City Rate | $ 14.25 |

| 2027 | City Rate | City Rate | City Rate | $ 15.00 |

| 2028 | City Rate | City Rate | City Rate | City Rate |

*Macro businesses = 10,001+ employees & Saint Paul employees

*Large businesses = 101 – 10,000 employees

*Small businesses = 6-100 employees

*Micro businesses = 5 or fewer employees