July 1 is almost here! Although January tends to get all the hype when it comes to the minimum wage, there are quite a few locations that schedule their minimum wage updates for the six-month mark of the year. Nevada is one of two states that requires employers to post updated minimum wage notices on July 1, with Oregon being the other.

July 1 is almost here! Although January tends to get all the hype when it comes to the minimum wage, there are quite a few locations that schedule their minimum wage updates for the six-month mark of the year. Nevada is one of two states that requires employers to post updated minimum wage notices on July 1, with Oregon being the other.

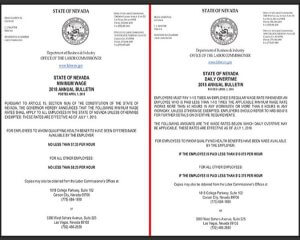

CPC has updated our signature Nevada All-On-One™ Labor Law Poster with the 2018 Nevada Minimum Wage and Daily Overtime Annual Bulletins to assist employers in complying with mandatory posting requirements for the upcoming year.

2018 NEVADA MINIMUM WAGE AND OVERTIME UPDATES

On April 1, 2018, the Office of the Labor Commissioner for the state of Nevada released the annual bulletins for Nevada’s Minimum Wage and Daily Overtime requirements. The rates, which go into effect on July 1, 2018, are unchanged from the previous year.

- If the employee is offered qualifying health benefits:

- The employee must be paid a minimum wage of at least $7.25 per hour.

- If the employee’s regular wage rate is less than $10.875 per hour, they must be paid 1 and ½ times their regular wage for hours worked in excess of 40 in a workweek or 8 per workday.

- An employee who is not offered qualifying health benefits:

- The employee must be paid a minimum wage of at least $8.25 per hour.

- If the employee’s regular wage rate is less than $12.375 per hour, they must be paid 1 and ½ times their regular wage for hours worked in excess of 40 in a workweek or 8 per workday.

In a recent decision, the Nevada Supreme Court clarified that “qualifying” health benefits must be equivalent in value to $1.00 per hour, offered as health insurance rather than wages.

The Nevada Minimum Wage and Daily Overtime Annual Bulletins have been updated with the current year, posting date, and effective date, making them compliant for the year of July 1, 2018 to June 30, 2019. CPC offers these mandatory notices as a two-on-one Peel ‘N Post update sticker for only $9.95, available in English or Spanish. (This option is only available for consumers who have previously purchased a Nevada All-On-One™ Labor Law Poster.)

The Nevada Minimum Wage and Daily Overtime Annual Bulletins have been updated with the current year, posting date, and effective date, making them compliant for the year of July 1, 2018 to June 30, 2019. CPC offers these mandatory notices as a two-on-one Peel ‘N Post update sticker for only $9.95, available in English or Spanish. (This option is only available for consumers who have previously purchased a Nevada All-On-One™ Labor Law Poster.)

If you’re looking for a complete compliance solution, order a 2018 Nevada All-On-One™ Labor Law Poster, consolidating all state and federal required postings onto one convenient and attractive wall poster, or a 2018 Nevada Mobile Poster Pak™ booklet for remote and mobile workers.

WHY DO I NEED TO UPDATE IF RATES HAVEN’T CHANGED?

The Constitution of Nevada requires the Office of the Labor Commissioner to recalculate the minimum wage rate every year according to a specific formula. The Labor Commissioner is also required to publish a bulletin on April 1 announcing the adjusted minimum wage and overtime rates to take effect on the following July 1.

The state Constitution additionally requires every employer to provide their employees with written notification of the adjusted rates. (The Labor Commissioner includes the Minimum Wage and Daily Overtime Annual Bulletins on its list of required employer postings, indicating that “written notification” must be accomplished via posting the notices in the workplace where they are visible to employees.)

Nevada’s minimum wage does not change often, by design. The state minimum wage will only rise if the federal minimum wage also rises. If there is an increase to the federal minimum wage, Nevada’s minimum wage rates will be recalculated in accordance with the federal minimum wage or with the cumulative increase in the cost of living – whichever is greater. However, the federal minimum wage has not changed since July of 2009, when it jumped from $6.55 per hour to $7.25 per hour in the last of a series of scheduled increases.

As a result, Nevada’s minimum wage and overtime rates remain unchanged. However, the requirements established by the state Constitution – that the Labor Commissioner publish a bulletin, and employers provide it to their employees – do not include an exemption for circumstances in which the rates do not change. These agency and employer responsibilities are in place regardless of whether the minimum wage and daily overtime rates actually change.

KEEP IN TOUCH WITH CPC!

To keep up with the latest in labor law news and posting compliance, follow us on Facebook, LinkedIn, or Twitter or subscribe to this blog! You can also contact us by phone, via email, or by chat to order one of CPC’s signature labor law compliance products or learn more about posting obligations for your location or industry.

Please keep in mind that we are unable to provide legal advice.

Permalink

So what effect if any is employee s that get tips-such as Waiter s?

Permalink

Hi Stephen,

In the state of Nevada, employees who receive tips are entitled to the same minimum wage rate as employees who do not receive tips. Under NRS 608.160, it is unlawful for any employer to apply tips or gratuities as a credit toward the payment of the statutory minimum hourly wage. (See the Nevada Department of Labor Tip Guide for more information on legal and illegal tip practices.)

I hope this is helpful. Thanks for reading!

-Katy

Permalink

What happen if the employee only works 2 days a week, 11 hrs each day. The over 8 hrs overtime rule apply?

Permalink

Hi Jamilette,

According to the Nevada Department of Labor FAQ:

I hope this is helpful. Thanks for reading!

-Katy

Permalink

I am wondering if there is a law that applies to employees who are on salary to earn overtime pay? If we are making a certain about on salary and working a certain number of hours a week.

Permalink

Hi Jenny,

Under Nevada law (NRS 608.018), employers are required to pay overtime rates for hours worked over 40 in a workweek or 8 in a workday to employees who receive compensation for employment at a rate less than 1 1/2 times the minimum rate. Employers are also required to pay overtime rates for hours worked over 40 to employees who receive compensation for employment at a rate more than 1 1/2 times the minimum rate. These requirements apply whether the employee’s compensation is paid on an hourly or salaried basis.

However, some employees are exempt from this overtime requirement based on their job type or industry. See the statute linked above for more information on overtime-exempt employees under state law.

Under federal law, employees who may be exempt due to their job type or industry must be paid on a salaried basis at a rate not less than $455 per week. See the Department of Labor Overtime Pay Fact Sheets for more information.

I hope this is helpful. Thanks for reading!

Katy

Permalink

I am paid hourly, Is it legal to make the employee work more than 8 hours a day ( with 1 hour overtime) and let me worked only 40 hours a week not to pay me overtime?

Permalink

Hi Hazel,

The answer to your question depends on specific information about your work situation and requires legal interpretation that we cannot provide. CPC is unable to provide legal advice.

The Nevada Department of Labor provides this plain-language FAQ about state overtime laws:

You can also read the text of Nevada’s wage and hour laws here for more in-depth information.

If you still have questions about how Nevada law pertains to your specific work situation, you can contact the Nevada Department of Labor for answers. The Nevada Department of Labor is responsible for enforcing Nevada’s wage and hour laws.

Thanks for reading,

Katy

Permalink

I’ve read in a couple other places that when considering the 8 hrs, some have read that it is over 8 hrs in ANY 24 hrs. So if you started at 4 PM on a Tuesday til 10pm (6hrs) then came back to work at 8am to 4 pm(8 hrs) then because in the 24 hrs the person started at 4pm (the start of their work day) ending at 4 PM the next day within the 24 hrs, 6 of those hrs would be paid time and one half rather then the regular hourly payment. Correct me if I am wrong this is what I have read from multiple sources.

Permalink

Hi Sara,

Non-exempt employees in Nevada are entitled to overtime pay if they work more than 8 hours in any workday, unless by mutual agreement the employee works a scheduled 10 hours per day for 4 calendar days within any scheduled week of work (NRS 608.018). Nevada law defines a “workday” as a period of 24 consecutive hours which begins when the employee begins work (NRS 608.010). The full text of these laws is available here.

If you would like to know how Nevada law applies to a specific situation, you should contact the Nevada Department of Labor or an employment lawyer in your area; CPC is not able to give legal advice on this or any matter.

Thanks for reading and I hope you found this helpful.

-Katy