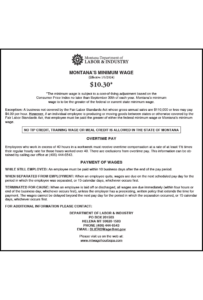

The Montana Department of Labor and Industry has updated the Minimum Wage posting with the new 2020 minimum wage rate. Most employees must be paid the minimum wage for all hours worked. (Montana Code Annotated 39-3-404) Hours worked includes preparation time, opening and closing the business, company travel, and required meetings and training. Some employees are exempt from the minimum wage provisions. (Montana Code Annotated 39-3-406) A business not covered by the Fair Labor Standards Act whose gross annual sales are $110,000 or less may pay $4.00 per hour. However, if an individual employee of such a business is producing or moving goods between states or is otherwise covered by the Fair Labor Standards Act, that employee must be paid the greater of either the federal minimum wage or Montana’s minimum wage. Employers may not use tips as credit toward wage rates, including minimum wage, to an employee.

The Montana Department of Labor and Industry has updated the Minimum Wage posting with the new 2020 minimum wage rate. Most employees must be paid the minimum wage for all hours worked. (Montana Code Annotated 39-3-404) Hours worked includes preparation time, opening and closing the business, company travel, and required meetings and training. Some employees are exempt from the minimum wage provisions. (Montana Code Annotated 39-3-406) A business not covered by the Fair Labor Standards Act whose gross annual sales are $110,000 or less may pay $4.00 per hour. However, if an individual employee of such a business is producing or moving goods between states or is otherwise covered by the Fair Labor Standards Act, that employee must be paid the greater of either the federal minimum wage or Montana’s minimum wage. Employers may not use tips as credit toward wage rates, including minimum wage, to an employee.

Every year, the Montana Department of Labor and Industry calculates the cost-of-living adjustment based on the increase in the Consumer Price Index (CPI), if any, from August of the preceding year to August of the year in which the calculation is made. If there is no increase in the CPI, no adjustment is made. If there is an increase, the state department will round the amount to the nearest five cents. Over the 12-month period of August 2018 and August 2019, there was a 1.75 percent increase in the CPI, resulting in a $.15 increase. Effective January 1, 2020, the minimum wage rate will increase from $8.50 per hour to $8.65 per hour.

Employers with a Montana All-On-OneTM Labor Law Poster can update their minimum wage posting with the 2020 Montana Minimum Wage Peel ‘N PostTM sticker for $9.95. If not, employers may order the updated 2020 Montana All-On-OneTM Labor Law Poster.

|

|