On December 31, 2019, New York Governor Andrew M. Cuomo announced the end of subminimum wage for miscellaneous industries. In 2018, the governor directed the New York State Labor Commissioner to examine the impact of minimum wage tip credits across different industries. The New York State Department of Labor held hearings and received comments from more than 3,000 individuals who work or worked for tips. The Department of Labor also monitored trends and reviewed scholarly research.

The Department of Labor found that miscellaneous workers, including nail salon workers, hairdressers, aestheticians, car wash workers, valet parking attendants, door-persons, tow truck drivers, dog groomers and tour guides, receive less in tips, and are confused about whether or not they are entitled to minimum wage or not. Employers also have a hard time keeping track of employee tips properly. Daily and weekly fluctuations make it difficult for workers to know whether they are being underpaid. Consequently, the Department of Labor recommended eliminating the tip credit for all miscellaneous industry workers. Governor Cuomo accepted the recommendations.

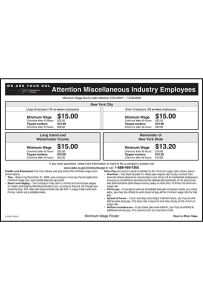

The elimination of the tip wage will be phased in over a one-year period. Starting June 30, 2020, the difference between the minimum wage and current tip wages will be cut in half, and on December 31, 2020 the tip wage will be eliminated. The mandatory New York Minimum Wage notice, titled Attention Miscellaneous Industry Employees, has been revised to reflect the new tip wages as of June 30, 2020. The rates are as follows:

The elimination of the tip wage will be phased in over a one-year period. Starting June 30, 2020, the difference between the minimum wage and current tip wages will be cut in half, and on December 31, 2020 the tip wage will be eliminated. The mandatory New York Minimum Wage notice, titled Attention Miscellaneous Industry Employees, has been revised to reflect the new tip wages as of June 30, 2020. The rates are as follows:

| New York City | Long Island & Westchester County | Remainder of New York State |

| $13.15 Cash Wage When tips are at least $1.85 per hour | $11.40 Cash Wage When tips are at least $1.60 per hour | $10.35 Cash Wage When tips are at least $1.45 per hour |

| $13.85 Cash Wage When tips are at least $1.15 per hour, but less than $1.85 per hour | $12.00 Cash Wage When tips are at least $1.00 per hour, but less than $1.60 per hour | $10.90 Cash Wage When tips are at least $.90 per hour, but less than $1.45 per hour |

All New York employers are required to have the most current minimum wage notice. (19 New York Labor Law, Sec. 661) Covered employers can comply with their posting requirement by obtaining the updated New York All-On-OneTM Labor Law Poster or the New York 2020 Minimum Wage Peel ‘N PostTM. Employers must post the notice where it can easily be read in the workplace. To purchase the labor law poster or Peel ‘N PostTM, click the links above or give us a call at 1-888-815-7497.

|

|