The Ohio Department of Commerce has updated the mandatory Minimum Wage posting to reflect an increase in Ohio’s minimum wage going into effect on January 1, 2021. All businesses subject to the minimum wage provisions of Ohio Revised Code (ORC §§ 4111.01-4111.17) must post the Ohio 2021 Minimum Wage posting in a conspicuous and accessible place in or about the premises where any employee works beginning January 1, 2021. (ORC § 4111.09)

The Ohio Department of Commerce has updated the mandatory Minimum Wage posting to reflect an increase in Ohio’s minimum wage going into effect on January 1, 2021. All businesses subject to the minimum wage provisions of Ohio Revised Code (ORC §§ 4111.01-4111.17) must post the Ohio 2021 Minimum Wage posting in a conspicuous and accessible place in or about the premises where any employee works beginning January 1, 2021. (ORC § 4111.09)

Compliance Poster Company (CPC) makes it easy to stay in compliance with the posting requirement:

- Choose the fully updated 2021 Ohio All-On-One Labor Law Poster™

– or –

- Choose the Ohio 2021 Minimum Wage Peel ‘N Post™ sticker to update your current Ohio All-On-One Labor Law Poster.

Employers who post the 2021 Ohio All-On-One Labor Law Poster or use Ohio 2021 Minimum Wage Peel ‘N Post stickers to update current Ohio All-On-One Labor Law Posters are guaranteed full compliance with posting responsibilities.

– and –

- For their remote or off-site workers, employers can also purchase the 2021 Ohio Mobile Poster Pak™ (MPP) or use the Ohio 2021 Minimum Wage Peel ‘N Post sticker designed to update existing Ohio Mobile Poster Paks. Mobile Poster Pak booklets contain all required State and Federal labor law postings. Distributing Mobile Poster Paks to remote workers ensures that they have received notice of their rights from their employer.

Minimum Wage – What’s New?

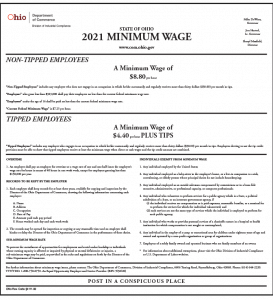

Pursuant to a 2006 voter-approved amendment to the Ohio Constitution (Art. II §34a), each year the Ohio Department of Commerce is required to adjust the minimum wage rate for inflation, as measured by the percentage increase in the Consumer Price Index (CPI) from the previous year rounded to the nearest five cents. From September 2019 to September 2020, the CPI rose 1.4%. Using this figure, the Department of Commerce determined that the minimum wage rate should increase by 10 cents in 2021.

The following minimum wage rates apply in 2021:

- Ohio minimum wage rate – $8.80 per hour

- Tipped employee minimum wage rate – $4.40 per hour

The minimum wage rate applies to employees of businesses with annual gross receipts of more than $323,000 per year. Businesses that gross $323,000 or less must pay their employees no less than the federal minimum wage rate.

Posting Enforcement

Ohio law imposes serious consequences for failure to post the official Ohio Minimum Wage posting as required under ORC § 4111.09. Failure to post is a misdemeanor of the fourth degree. (ORC §§ 4111.99, 4111.13). Under Ohio law, a misdemeanor of the fourth degree carries a fine of up to $250 and potential jail time of up to 30 days. (ORC §§ 2929.28, 2929.24). Furthermore, each day that the Ohio Minimum Wage posting is not posted constitutes a separate offense. (ORC § 4111.13).

Buy the 2021 Ohio All-On-One Labor Law Poster or 2021 Ohio Minimum Wage Peel ‘N Post today and you’ll be in compliance by New Year’s Day!

|

|