California Minimum Wage

California Minimum Wage

In California, the welcome news for low wage workers this January was a $1.00 per hour increase in the state’s minimum wage rate. Beginning January 1, 2020, employers with 26 or more employees must pay their workers at least $13.00 per hour. Employers with 25 or fewer employees must be paid no less than $12.00 per hour. This year’s increase is the fourth in a series of seven minimum wage increases that began in 2017 and continue until the minimum wage rate reaches $15.00 per hour, which for large employers occurs in 2022 and for small employers occurs in 2023.

Fine-tuning Fair Employment Practices

The minimum wage increase is not the only significant change California employees will experience this year. Recently amended laws give employees more protection from discrimination, more time to assert unfair treatment by their employers, and more benefits when they are caring for a newborn or an ailing family member. Here’s how employees’ human rights have changed:

- Protective Hairstyles – The California Fair Employment and Housing Act (FEHA) prohibits discrimination in employment based on certain protected characteristics, including race. An amendment of the law that went into effect this year provides that the term “race” is inclusive of traits historically associated with race, including, but not limited to, hair texture and protective hairstyles. This includes hairstyles as braids, locks, and twists.

- FEHA Limitation of Actions – Another amendment of the FEHA that went into effect this year increases to three years the time within which an employee may file a DFEH complaint based on unlawful workplace harassment or discrimination.

- Sexual Harassment Training – The FEHA requires employers to provide all employees with sexual harassment prevention training. For employees who have not already received training, the deadline to complete the first round of training has been extended to January 1, 2021. Employees must be retrained once every two years.

- Paid Family Leave (PFL) – The PFL program provides wage replacement benefits for employees taking time off to care for a seriously ill family member or to bond with a newborn or newly adopted child. This year, the maximum weekly benefit increases to $1,300. Effective July 1, 2020, the duration of PFL benefits increases from six to eight weeks.

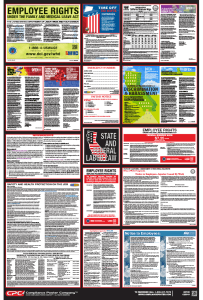

Updated Required Workplace Postings

Several of California’s required workplace postings were recently revised to reflect these changes. These are:

- Workplace Discrimination and Harassment

- Your Rights and Obligations as a Pregnant Employee

- Family Care & Medical Leave & Pregnancy Disability Leave

- Transgender Rights in the Workplace

The workplace posting updates have been incorporated onto our 2020 California All-On-One™ Labor Law Posters and included in California Mobile Poster Paks™. Employers are reminded to post the updated California labor law poster to remain in compliance with current posting responsibilities.

Don’t forget to also order copies of California’s recently updated required pamphlets:

- California Disability Insurance Pamphlet

- California Employee Tax Information/EITC Booklet

- California Unemployment Insurance Pamphlet

- California Workers’ Compensation Time of Hire Pamphlet

- California Paid Family Leave Pamphlet

|

|