Who must post the City of Baltimore Living Wage Poster?

The Baltimore Living Wage Law applies to contractors, and their subcontractors, with “service contracts” designated by the Board of Estimates. (Baltimore City Code, art. 5, § 26-1). The law requires covered service contractors to post the Baltimore MD Living Wage Poster at the worksite in a prominent place where it can be easily seen and read by the service workers. (Bal. City Code § 26-5). Also, at the request of a service worker, the service contractor must provide, within a reasonable period after the request, a copy of the Living Wage notice.

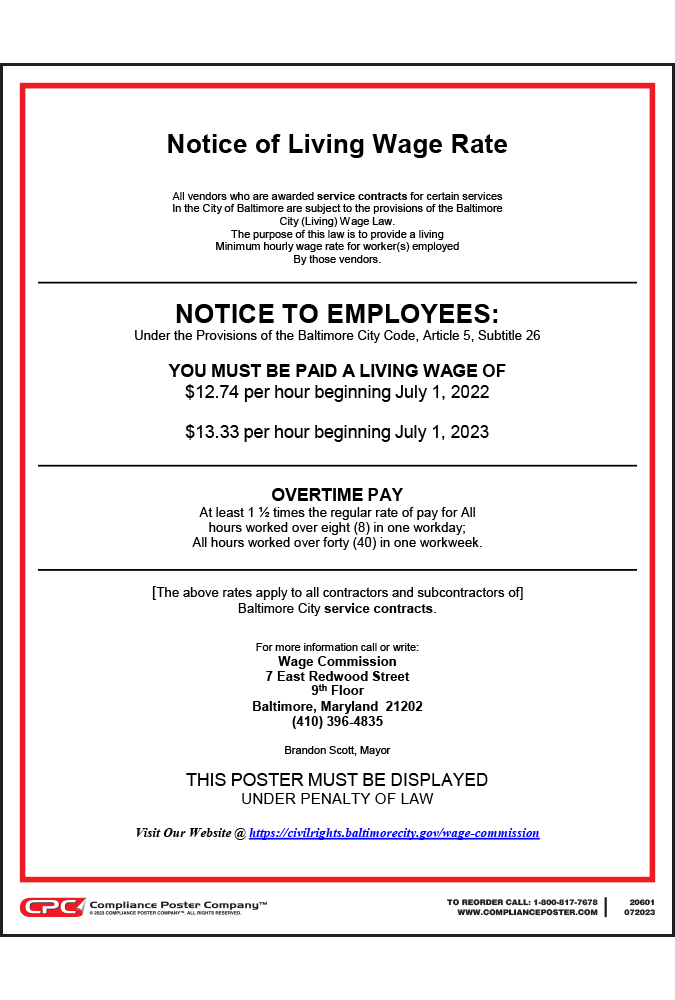

What does the City of Baltimore Living Wage Poster cover?

The Living Wage Poster informs service workers of the Living Wage rate established each year by the Board of Estimates. The Living Wage rate is based on federal poverty guidelines accounting for inflation and other factors. Employees of service contractors may not be paid less than the effective living hourly wage rate for work performed on a covered contract. The poster also informs service workers that the overtime rate is 1½ times the regular hourly rate of pay for all hours over 8 hours in any workday, or 40 hours in any workweek. The poster provides contact information for the Baltimore Wage Commission and a web address where workers can obtain more information about their rights.

How is the City of Baltimore Living Wage Law enforced?

If any service worker is paid less than the amount due to the service worker, the service contractor must make restitution to the service worker for the amount due and pay to the City a penalty of $50 per day for each underpaid service worker. Each day of underpayment is a separate offense. A service worker who has been paid less than the Living Wage rate may file a complaint with the Wage Commission within one year of the date of the payment in question. A service contractor is prohibited from discharging, reducing the compensation of, or otherwise discriminating against a service worker for making a complaint to the Wage Commission. Service contractors face criminal penalties and possible debarment for intentional Living Wage violations.