Who must post the 2024 Indiana Unemployment Insurance Peel ‘N Post?

- Every Indiana employer who is liable for the payment of unemployment contributions must post and maintain the Indiana Department of Workforce Development (DWD) Unemployment Insurance posting in places readily accessible to all employees to inform them of how to file a claim for unemployment insurance benefits and their rights under the law. (IC §§ 22-4-9-6, 22-4-17-1)

- If the employer does not have a permanent common worksite that is regularly visited by all employees, the employer may provide the Unemployment Insurance posting directly to its remote employees. (UI – Employer Handbook, DWD, 2023).

Updating your Indiana All-On-One™ Poster

Indiana employers who have an existing Indiana All-On-One Labor Law poster can easily update their poster with the Indiana Unemployment Insurance Peel ‘N Post sticker by selecting the Unemployment Insurance All-On-One Poster Peel ‘N Post, in the appropriate language, from the dropdown menu above.

Updating your Indiana Mobile Poster Pak™

Indiana employers who have an existing Indiana Mobile Poster Pak (MPP) booklet can update their MPP booklet by selecting the Unemployment Insurance MPP Peel ‘N Post sticker, in the appropriate language, from the dropdown menu above.

What’s new?

The changes to the Indiana Department of Workforce Development (DWD) Unemployment Insurance posting include:

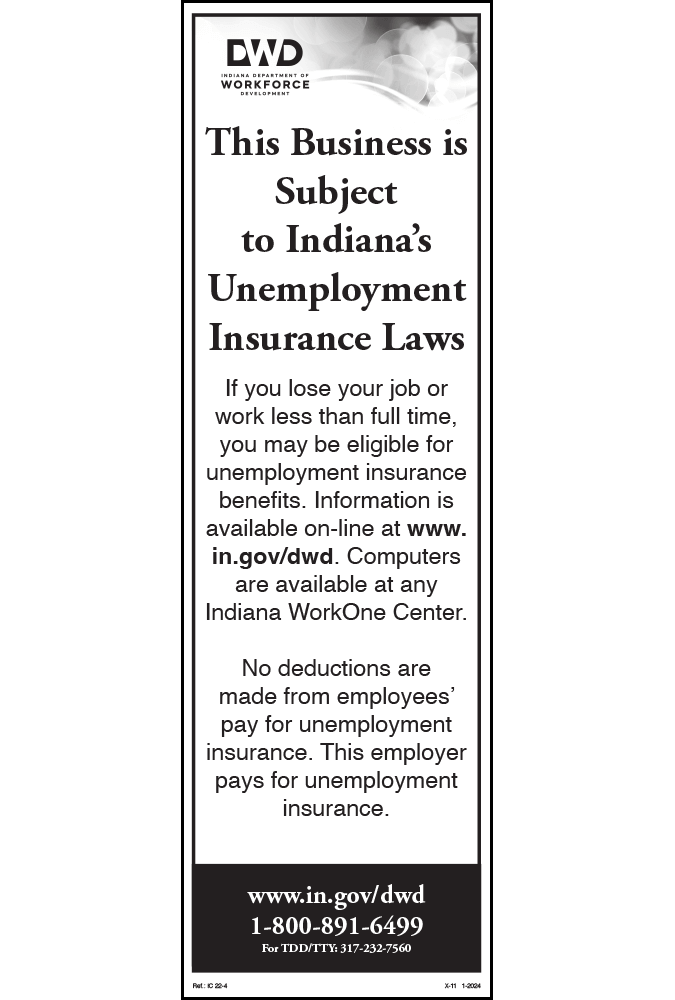

- Clarification that employers pay for unemployment insurance.

- The revised wording eliminates the possible confusion between the employer’s responsibility to pay the tax to fund unemployment insurance and the employee’s responsibility to pay income tax on unemployment income.

- Addition of a TDD/TTY number for individuals who use TDD/TTY devices.

- The number was added following recently issued DWD guidance to improve language and document accessibility for all agency programs.