Who must post the Louisiana 2024 Earned Income Credit (EIC) All-On-One Poster Peel ‘N Post™?

- Notice to employees of the Federal Earned Income Tax Credit (EIC) applies to any Louisiana business establishment that has twenty or more full-time or part-time employees. (R.S. 23:1018.1)

- Louisiana law requires the Louisiana Workforce Commission to update the EIC notice whenever the IRS changes the EIC eligibility requirements. (R.S. 23:1018.2).

- Employers must post the EIC notice provided by the Louisiana Workforce Commission in the same location where other employee notices required by state or federal law are posted. (R.S. 23:1018.2)

How do I comply?

- Employers with an existing Louisiana All-On-One Labor Law Poster (English or Spanish) can maintain compliance using the 2024 EIC All-On-One Poster Peel ‘N Post™. Simply apply the 2024 EIC Peel ‘N Post over the 2023 EIC posting located on your All-On-One Poster.

- Because of multiple posting changes to Louisiana Mobile Poster Paks (MPPs), EIC Peel ‘N Post stickers are not available for Louisiana MPPs and a full 7/2024 MPP update is required.

What changed?

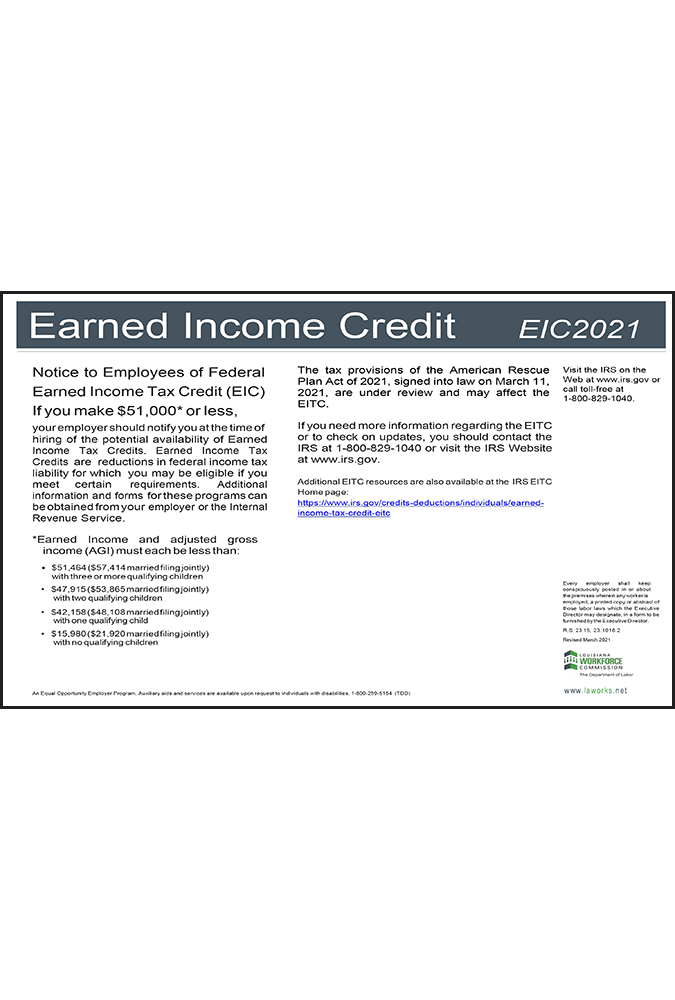

The 2024 EIC posting has been updated to reflect the IRS’ Tax Year 2024 (filed by April 15, 2025) income maximums for EIC eligibility and new hire notification, as follows:

- New hire EIC notification – $60,000 or less

- Maximum income amounts for EIC eligibility:

- $59,899 ($66,819 married filing jointly) with three or more qualifying children

- $55,768 ($62,688 married filing jointly) with two qualifying children

- $49,084 ($56,004 married filing jointly) with one qualifying child

- $18,591 ($25,511 married filing jointly) with no qualifying children