Who must post the Ohio 2024 Minimum Wage Peel ‘N Post?

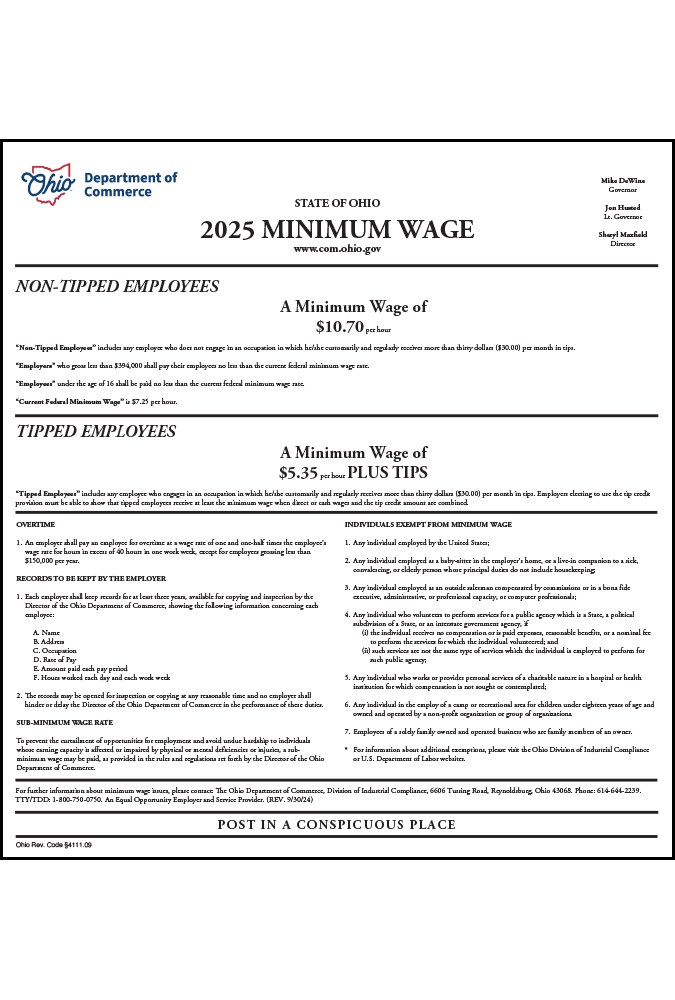

Every Ohio employer is required to post the approved Ohio 2024 Minimum Wage posting to inform employees of the effective minimum wage rate and wage standards, including information on overtime pay, recordkeeping, businesses that exempt from State minimum wage and overtime pay requirements, and individuals who are exempt from minimum wage requirements. The notice must be posted in a conspicuous and accessible place in or about the premises of the employer wherein any person subject thereto is employed. (ORC § 4111.09).

Employers with an existing Ohio All-On-One™ Labor Law Poster can comply with the mandatory posting requirement using the Ohio 2024 Minimum Wage Peel ‘N Post update sticker formatted for Ohio All-On-One Posters. Employers can also keep remote employees informed of the current minimum wage rate and wage and hour standards using the Ohio 2024 Peel ‘N Post sticker for Ohio Mobile Poster Paks.™

What’s new?

The Ohio 2024 Minimum Wage Poster reflects the annual, inflation-adjusted minimum wage rate in effect for the 2024 calendar year. The new minimum wage rates takes effect as of January 1, 2024. The minimum wage rate for tipped employees is also adjusted on an annual basis. If a tipped employee does not earn enough in tips together with the 2024 tipped employee minimum wage rate to equal the 2024 general minimum wage rate, the employer must make up the difference.

Employers whose volume of business is less than the gross income threshold specified on the 2024 Minimum Wage Poster, are required to pay their employees at least the federal minimum wage rate, currently $7.25 per hour.

How is the Ohio minimum wage posting requirement enforced?

An employer who violates the posting requirement is guilty of a misdemeanor of the fourth degree. (ORC § 4111.13(D); § 4111.99). In Ohio, misdemeanors of the fourth degree are punishable by a maximum jail sentence of 30 days and a fine not to exceed $250.