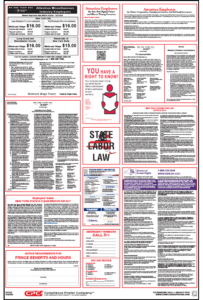

Employers in the state of New York are required to update their labor law posters to be in compliance with new state changes. The changes include an increase in the minimum wage rate and updates concerning the New York Wage Deduction Law.

Employers in the state of New York are required to update their labor law posters to be in compliance with new state changes. The changes include an increase in the minimum wage rate and updates concerning the New York Wage Deduction Law.

Our readers may recall that during the 2016 legislative session, Senate Bill 6406 was enacted, raising the state minimum wage for all hourly wage workers in accordance with a prescribed schedule. Effective December 31, 2017, the following minimum wage rates will increase to:

- $13.00 per hour for workers in New York City employed by large businesses (11 or more employees),

- $12.00 per hour for workers in New York City employed by small businesses (10 or less employees),

- $11.00 per hour for workers in Nassau, Suffolk and Westchester Counties, and

- $10.40 per hour for workers in rest of the state.

After December 31, 2020, the minimum wage will continue to increase on an indexed schedule to be set by the Director of the Division of Budget in consultation with the Commissioner of Labor.

In 2015, the New York Wage Deduction Law was extended three years. The law was set to expire on November 6, 2015. The law sets forth permissible deductions from wages, including deductions for accidental overpayments and salary advances. The outdated date has been removed from the Deductions from Wages posting.

Employers can stay compliant by purchasing the updated New York All-On-OneTM Labor Law Poster, or by calling our Compliance Advisors at 1-800-817-7678. Order today!