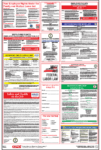

Montana’s 2021 Minimum Wage Posting is Here

The Montana Department of Labor and Industry has updated the Minimum Wage posting with the new 2021 minimum wage rate. The rate applies to most employees in Montana, with limited exceptions including tipped employees. A business not covered by the Fair Labor Standards Act whose gross annual sales are $110,000 or less may pay $4.00 Read more