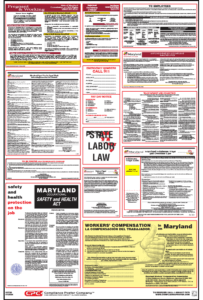

The Maryland Department of Labor, Licensing and Regulation has released a required update to the Maryland Minimum Wage and Overtime Law Notice following the enactment of legislation (HB 166) in March incrementally raising the state minimum wage rate to $15.00 per hour. To put this law in place, state lawmakers had to override Maryland Governor Larry Hogan’s initial veto of the bill. The bill became law on June 1, 2019, making Maryland the sixth state to establish a $15 minimum wage. California, New York, Massachusetts, Illinois, New Jersey and the District of Columbia have also adopted $15 minimum wage laws.

The Maryland Department of Labor, Licensing and Regulation has released a required update to the Maryland Minimum Wage and Overtime Law Notice following the enactment of legislation (HB 166) in March incrementally raising the state minimum wage rate to $15.00 per hour. To put this law in place, state lawmakers had to override Maryland Governor Larry Hogan’s initial veto of the bill. The bill became law on June 1, 2019, making Maryland the sixth state to establish a $15 minimum wage. California, New York, Massachusetts, Illinois, New Jersey and the District of Columbia have also adopted $15 minimum wage laws.

Maryland Minimum Wage Increase Schedule

Currently, the Maryland minimum wage rate is $10.10 per hour. Under the new law, the minimum wage will increase incrementally, as follows:

| Effective Date | Employers with 15 or more employees | Employers with 14 or fewer employees |

| January 1, 2020 | $11.00 per hour | $11.00 per hour |

| January 1, 2021 | $11.75 per hour | $11.60 per hour |

| January 1, 2022 | $12.50 per hour | $12.20 per hour |

| January 1, 2023 | $13.25 per hour | $12.80 per hour |

| January 1, 2024 | $14.00 per hour | $13.40 per hour |

| January 1, 2025 | $15.00 per hour | $14.00 per hour |

| January 1, 2026 | $15.00 per hour |

Wage rates for the current and next two years are reflected on the updated Minimum Wage and Overtime Law Notice.

The new law makes two changes which go into effect this month: (1) amusement and recreational establishments must pay employees the state minimum wage rate, and (2) employers may pay 85% of the state minimum wage rate to employees under the age of 18. Previously, the age limit was 20. The law also requires the Commissioner of Labor and Industry adopt tip regulations requiring restaurant employers that use a tip credit to provide tipped employees with a written or electronic wage statement for each pay period showing the employee’s “effective hourly tip rate” as derived from employer-paid cash wages plus tips for each workweek of the pay period. The Minimum Wage and Overtime Law Notice on the Maryland All-On-One™ Labor Law Poster has been revised to integrate these changes.

Maryland Wage Payment and Collection Act Update

Last fall, Maryland’s General Contractor Liability for Unpaid Wages Act went into effect. The law makes a general contractor in the construction services industry directly liable to the employees of a subcontractor for unpaid wages, even if the general contractor and subcontractor do not have a direct contractual relationship. The law requires the subcontractor to indemnify the general contractor for the amounts owed, except when the general contractor and subcontractor have an indemnification agreement or when the subcontractor’s failure to pay wages is due to the general contractor’s failure to make timely payments to the subcontractor. The Wage Payment and Collection Act Notice included on the Maryland All-On-One Poster reflects the new construction industry standards.

Maryland Minor Fact Sheet

The Minor Fact Sheet is included in our Maryland Mobile Poster Pak.™ Several occupations have been added to the list of occupations too hazardous for minors. Specifically, occupations forbidden to all minors include:

- work in plants or establishments manufacturing or storing explosives, and

- occupations involved in excavation operations

Employment restricted for minors 14 and 15 years of age now includes occupations in connection with:

- hoisting apparatus,

- public messaging service,

- certain poultry activities,

- certain baking and cooking, and

- transportation of persons or property

Contact information for the U.S. Department of Labor’s (DOL) Hyattsville office was removed Minor Fact Sheet. Individuals with questions may still contact the DOL’s Baltimore office.

Ensure Your Workplace Posters are Current

Our Maryland All-On-One Posters and Mobile Poster Paks have been revised to reflect Maryland’s recent labor law changes. Changes are already in effect. Order your All-On-One Poster today!

|

|