Saint Paul, MN Minimum Wage Ordinance

On November 15, 2018, the Mayor of Saint Paul, MN signed an ordinance which institutes a municipal minimum wage for the City. The ordinance sets different rates for the city government and for private employers depending on the number of employees.

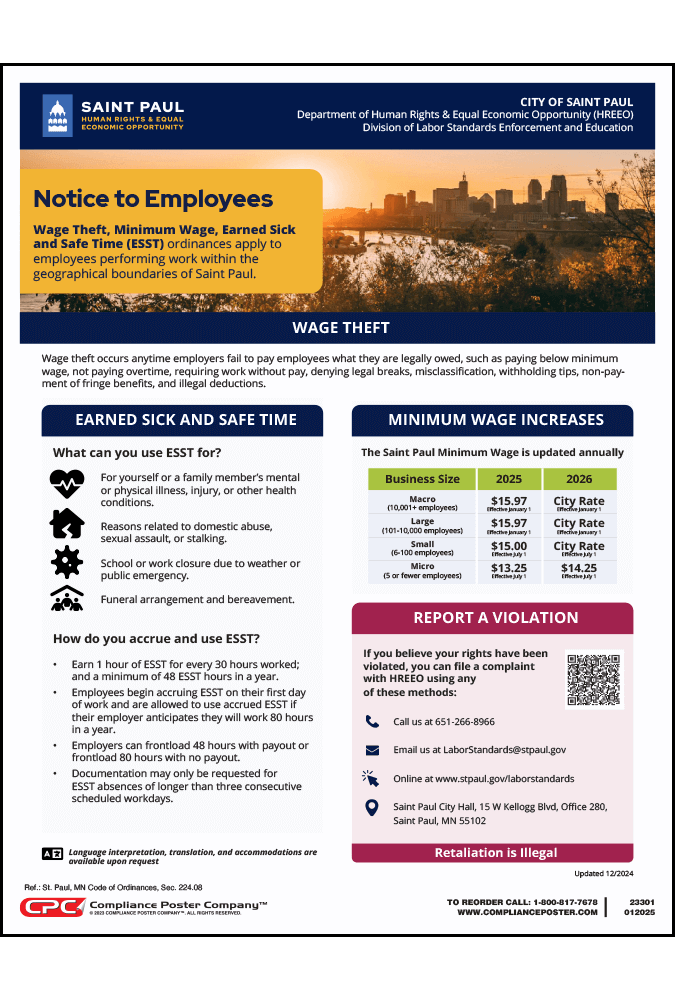

| Date | Macro* | Large* | Small* | Micro* |

| 2022 | $ 15.00 | $ 13.50 | $ 12.00 | $ 10.75 |

| 2023 | $15.19 | $ 15.00 | $ 13.00 | $ 11.50 |

| 2024 | $15.57 | $15.57 | $ 14.00 | $ 12.25 |

| 2025 | 15.97 | 15.97 | $ 15.00 | $ 13.25 |

| 2026 | City Rate | City Rate | City Rate | $ 13.25 |

| 2027 | City Rate | City Rate | City Rate | $ 15.00 |

| 2028 | City Rate | City Rate | City Rate | City Rate |

*Macro businesses = 10,001+ employees & Saint Paul employees

*Large businesses = 101 – 10,000 employees

*Small businesses = 6-100 employees

*Micro businesses = 5 or fewer employees

Saint Paul, MN Earned Sick and Safe Time Ordinance

Employee who perform work within the geographic bounds of the City for at least 80 hours per year must accrue at least 1 hour of earned sick and safe time (ESST) per 30 hours worked in the City. Employees begin accruing ESST on the first day of employment. ESST may be used for an employee or family member’s mental or physical illness, including preventative care, or for reasons related to domestic violence, sexual assault, stalking, school closures due to inclement weather or other public safety issues affecting an employee or an employee’s family member.

St Paul, MN Wage Theft

Wage theft occurs any time employers fail to pay employees what they are legally owed, such as paying below minimum wage, not paying overtime, requiring work without pay, denying legal breaks, misclassification, withholding tips, non-payment of fringe benefits, and illegal deductions. This ordinance strengthens workers protection rights.

Who Does the Ordinances Cover?

The Ordinances cover all employees performing work within the Saint Paul city limits. “Employee” is defined the same way the State of Minnesota defines employee at Minnesota Statutes Sec. 177.23. For purposes of the ordinance, “employee” does not include the following:

- Employees classified as extended employment program workers as defined in Minnesota Rules part 3300.2005, subpart 18 and participating in the Minnesota Statutes Sec. 268A.15 extended employment program.

- Persons with disabilities receiving home and community-based services identified in Minnesota Statutes Sec. 245D.03, subdivision 1, paragraph (c), clauses (4), (5), (6), and (7).

- Independent contractors.

Posting Requirement

- Every employer covered by the Saint Paul, MN Minimum Wage Ordinance is required to give notice on an annual basis that employees are entitled to the minimum wage and have the right to report a violation if payment of minimum wage is denied, or retaliated against for requesting payment of minimum wage, or retaliated against for reporting a violation of the law.

- Every employer covered by the Saint Paul, MN Earned Sick and Safe Time Ordinance is required to give notice that: employees are entitled to earned sick and safe time; the amount of earned sick and safe time and the terms of its use guaranteed under the ordinance; that retaliation against employees who request or use earned sick and safe time is prohibited; and that each employee has the right to file a complaint or bring a civil action if earned sick and safe time is denied by the employer or the employee is retaliated against for requesting or taking earned sick and safe time.

- Employers can comply with the notice requirements by displaying the City of Saint Paul Minimum Wage & Earned Sick and Safe Time Poster in a conspicuous and accessible place in each establishment where covered employees are employed, such as in a breakroom, by a punch clock, or in a common work meeting room. (Saint Paul, MN Code of Ordinances, Sec. 224.08(c); Sec. 233.07)

- Every Employer must post, the St. Paul Wage Theft Ordinance in a conspicuous place at any workplace or job site in the City where any Employee works, where they can be readily observed and easily reviewed by Employees. (Saint Paul, Minnesota’s Legislative Code § 224A Sec. 224A.09)