You may also like…

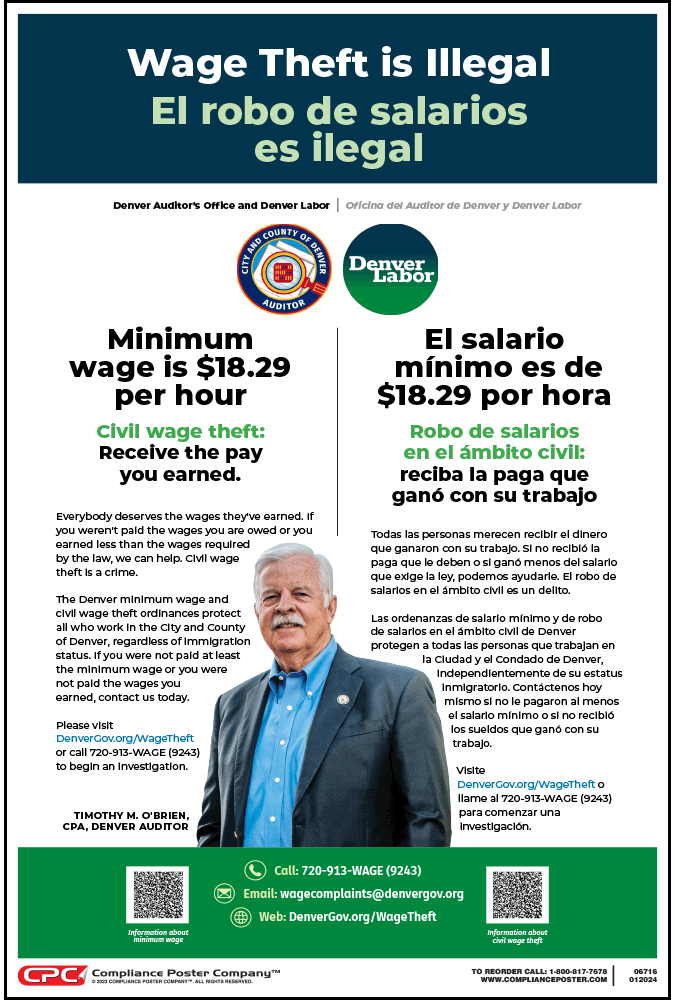

What is the Denver Minimum Wage & Civil Wage Theft Ordinance?

The Denver, CO Minimum Wage Ordinance first went into effect on January 1, 2020. The law established a series of minimum wage rate increases for the first three years of operation and beginning January 1, 2023, requires the minimum wage rate to be adjusted annually for inflation based on increases in the Consumer Price Index. (DRMC § 58-15).

The Ordinance was amended in 2023 (Bill 22-1614) to include civil wage theft protections that:

- give workers who have lost wages due to wage theft the right to civil recovery of wages lost due to wage theft or underpayment of the minimum wage with assistance of the Denver Auditor’s Office or through private legal action against the employer, and

- authorize the auditor to assess substantial penalties against an employer who has violated wage payment requirements or contravened workers protections.

Other key provisions:

Minimum Wage

- Every employer who employs a worker to perform at least four (4) hours of work per week within the geographic boundaries of the City and County of Denver is required to pay the worker no less than the effective minimum wage rate. Employers of tipped employees are permitted to use tip income (tip credit) of up to $3.02 per hour to offset payment of the minimum wage rate to tipped employees.

- Minimum wage provisions apply to full- and part-time employees, temporary workers, agents or any other person performing work on behalf of or for the benefit of an employer.

- Minimum wage requirements do not apply to independent contractors and volunteers.

Retaliation

An employer is prohibited from:

- taking any adverse action against a worker for exercising their rights under the law, or

- communicating an intent to inform a government agency of the protected person’s, or the protected person’s family members’ immigration or citizenship status.

Recordkeeping & Posting

Employers are required to:

- retain payroll records for covered workers for a period of at least 3 years, and

- post in a place that is prominent and accessible to worker the auditor’s notice informing workers of the minimum wage rate, that wage theft is a crime, that workers are entitled to civil recovery of unpaid wages they are owed, and that complaints may be filed with the auditor’s office. The notice must be displayed in English and Spanish. (DRMC § 58-2)