Who must post the Oklahoma 2025 Unemployment Insurance Benefits Peel ‘N Post?

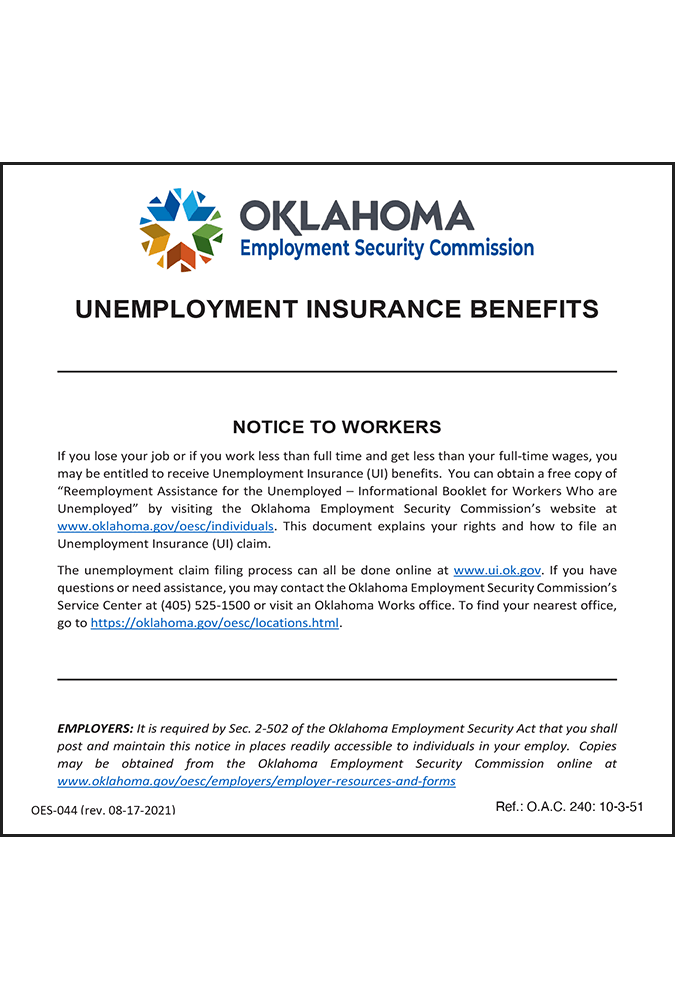

- Employers who contribute to Oklahoma’s Unemployment Insurance tax are required under Section 2-502 of the Oklahoma Employment Security Act to post the Unemployment Insurance Benefits, Notice to Worker (OES-044) poster in places readily accessible to employees. (O.A.C. 240:10-3-51).

- For remote workers who do not visit the employer’s premises, the regulations permit individual notice to such employees and electronic posting.

What’s new?

- The 2025 Unemployment Insurance Benefits posting shows the web address of the new Unemployment Insurance (UI) claimant portal.

- The Oklahoma Security Commission reports that the new claimant portal is designed to deliver a more secure, more intuitive, and mobile‑friendly experience. Some of the features include seamless capability across desktops, tablets, and smartphones; innovative identity‑proofing measures and robust fraud‑detection tools; a simplified user experience; and, faster performance of routine tasks, such as submitting claims, uploading documents, and filing weekly certifications.