This year, Nevada lawmakers enacted several new laws that expand employee protections and create new employee rights, affecting the Nevada labor law posting responsibilities of all Nevada businesses. Higher wages, employee health benefit plan requirements, employee paid time off and sick day notification are just a few of the legislative measures that will improve the working conditions of Nevada employees. The workplace may be a safer place, too. Legislators passed a law authorizing increases in the penalties that may be assessed against employers who violate the state’s occupational safety and health laws.

Compliance Posting Changes

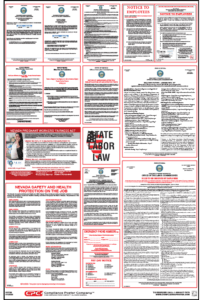

These new laws are reflected on the following newly released, mandatory workplace postings:

- Minimum Wage Annual Bulletin

- Daily Overtime Bulletin

- Rules to be Observed by Employers

- Notice Employee is Sick or Injured

- Paid Leave

- Safety and Health Protection on the Job

In this first part of a two-part series of Nevada blog posts, we will take a closer look at the changes made to three of these postings: the Minimum Wage Annual Bulletin, the Daily Overtime Bulletin, and the Rules to be Observed by Employers posting. Tomorrow, we will examine the three remaining postings and the legal changes employers will want to be mindful of going forward.

Minimum Wage Annual Bulletin

Nevada’s required Minimum Wage Annual Bulletin has been revised to reflect the minimum wage rate that will be in effect each year from July 1, 2019 through July 1, 2024. It also references the two bills enacted this year that impact minimum wages, Assembly Bill 456 and Senate Bill 192.

- Assembly Bill 456 – Minimum Wage

Nevada has a two-tier minimum wage structure which permits private employers to pay a lower minimum wage rate if they make qualifying health benefits available to their employees and their employees’ dependents. An employer that does not offer qualified health benefits is required to pay a higher minimum wage rate.

Starting next year, the Labor Commissioner is no longer responsible for determining whether an increase in the annual minimum wage rate is warranted. Assembly Bill 456 increases the statewide minimum wage rate by statute. On July 1, 2020, the minimum wage rate increases from $7.25 to $8.00 per hour for employees who are offered health benefits and increases from $8.25 to $9.00 per hour for employees who are not offered health benefits. Each year thereafter, the minimum wage rate will increase 75 cents until the minimum wage reaches $11.00 per hour, with health benefits, and $12.00 per hour without health benefits in 2024.

- Senate Bill 192 – Health Benefits

Senate Bill 192, which is mentioned on the Minimum Wage Bulletin, establishes the minimum level of health benefits that an employer is required to offer for purposes of determining the applicable minimum wage rate. A qualifying health benefit plan must provide coverage for:

- Ambulatory patient services;

- Emergency services;

- Hospitalization;

- Maternity and newborn care;

- Mental health and substance use disorder services;

- Prescription drugs;

- Rehabilitative and habilitative services and devices;

- Laboratory services;

- Preventive and wellness services and chronic disease management;

- Pediatric services; and

- Any other health care service or coverage level that is required by the Nevada Insurance Code.

The are other requirements that qualifying plans must meet. The law takes effect on January 1, 2020.

Daily Overtime Bulletin

The Daily Overtime Bulletin has been revised to clarify each of the factors that, if present, require paying an employee overtime at 1 ½ times the employee’s regular rate of pay. These factors include whether an employee has: (1) worked over 8 hours in a 24-hour period or over 40 in a week, (2) been offered qualified health benefits, and (3) earns less than 1 ½ times the Nevada minimum wage rate. Currently, overtime pay is required for any daily or weekly overtime hours an employee works if the employee:

- is paid less than $10.875 per hour and has health benefits, or

- is paid less than $12.375 per hour and does not have health benefits.

The posting also clarifies that overtime pay of 1 ½ times the employee’s regular rate of pay is required whenever an employee who earns more than 1 ½ times

the Nevada minimum wage rate works over 40 hours in a workweek. The posting requirement takes effect immediately.

Rules to be Observed by Employers

The Rules to be Observed by Employers posting contains several technical revisions, wage and hour clarifications, and changes made as a result of recent legislative activity. Highlights of the posting update include:

- An update of the minimum wage paragraph reflecting that current minimum wage rates are effective from July 1, 2019, and that health benefits for the purpose of determining the applicable wage rate must be “qualified” (SB 192);

- Addition of a paragraph stating that employers and employees may agree in writing to exclude from the employee’s wages a sleeping period of up to 8 hours, if adequate sleeping facilities are furnished;

- Clarification that deductions from an employee’s wages must be agreed to in writing by both employer and employee for a specific purpose, pay period, and amount;

- Addition of a paragraph explaining that an employee is not required to be physically present in the workplace to give an employer notice that the employee is sick or injured and cannot work (AB 181);

- Addition of a paragraph briefly describing the new Paid Leave Law (SB 312) which requires employers with 50 or more employees to provide their employees with paid leave that can be used for any purpose. The posting covers the hourly accrual rate, carry over and compensation responsibilities.

The posting requirement takes effect immediately.

What’s Next?

Most of the changes made to Nevada compliance postings are effective immediately so employers are advised to post Compliance Poster Company’s fully revised, 100% compliant Nevada All-On-One™ Poster right away. No additional posting changes are anticipated for this year.

Please be sure to read the second part of our blog about Nevada changes tomorrow. We will detail new information covered on the three other mandatory workplace postings – Notice Employee is Sick or Injured, Paid Leave, and Safety and Health Protection on the Job – and the laws giving rise to these new posting requirements.

|

|