July is almost here! Although January tends to get all the hype when it comes to the minimum wage, there are quite a few locations that schedule their minimum wage updates for the six-month mark of the year. Nevada is one of two states that requires employers to post updated minimum wage notices on July 1, with Oregon (coming soon!) being the other.

July is almost here! Although January tends to get all the hype when it comes to the minimum wage, there are quite a few locations that schedule their minimum wage updates for the six-month mark of the year. Nevada is one of two states that requires employers to post updated minimum wage notices on July 1, with Oregon (coming soon!) being the other.

To assist employers in fulfilling their mandatory poster requirements, CPC has updated our signature workplace compliance product, the Nevada All-On-One™ Labor Law Poster, with the 2019 Nevada Minimum Wage and Daily Overtime Annual Bulletins. Employers can obtain a full poster update for $31.95 or or purchase a Peel ‘N Post update sticker – the earth-friendly and cost-effective alternative to poster subscription services – for only $9.95.

2019 NEVADA MINIMUM WAGE AND OVERTIME UPDATES

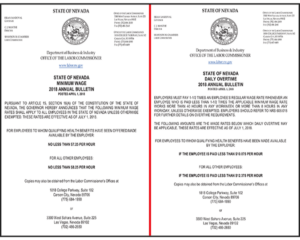

On April 1, 2019, the Office of the Labor Commissioner for the state of Nevada released the 2019 Nevada Minimum Wage and Daily Overtime bulletins, which reflect the department’s annual rate readjustment. The rates, which go into effect on July 1, 2019, are unchanged from the previous year.

- If the employee is offered qualifying health benefits:

- The employee must be paid a minimum wage of at least $7.25 per hour.

- If the employee’s regular wage rate is less than $10.875 per hour, they must be paid 1 and ½ times their regular wage for hours worked in excess of 40 in a workweek or 8 per workday.

- An employee who is not offered qualifying health benefits:

- The employee must be paid a minimum wage of at least $8.25 per hour.

- If the employee’s regular wage rate is less than $12.375 per hour, they must be paid 1 and ½ times their regular wage for hours worked in excess of 40 in a workweek or 8 per workday.

The Nevada Minimum Wage and Daily Overtime Annual Bulletins have been updated with the current year, posting date, and effective date, making them compliant for the period between July 1, 2019 and June 30, 2020. CPC offers these mandatory notices as a two-on-one Peel ‘N Post update sticker for only $9.95, available in English or Spanish. (This option is only available for employers who have previously purchased a Nevada All-On-One™ Labor Law Poster.)

The Nevada Minimum Wage and Daily Overtime Annual Bulletins have been updated with the current year, posting date, and effective date, making them compliant for the period between July 1, 2019 and June 30, 2020. CPC offers these mandatory notices as a two-on-one Peel ‘N Post update sticker for only $9.95, available in English or Spanish. (This option is only available for employers who have previously purchased a Nevada All-On-One™ Labor Law Poster.)

If you’re looking for a complete compliance solution, order a 2019 Nevada All-On-One™ Labor Law Poster, consolidating all state and federal required postings onto one convenient and attractive wall poster, or a 2019 Nevada Mobile Poster Pak™ booklet for remote and mobile workers.

WHY DO I NEED TO UPDATE IF RATES HAVEN’T CHANGED?

Under Nevada’s current minimum wage structure, the rate does not change often. The state minimum wage will only increase if there is an change to the federal minimum wage. If the federal minimum wage rises, Nevada’s minimum wage rates will be recalculated in accordance with the federal minimum wage or with the cumulative increase in the cost of living – whichever is greater. However, the federal minimum wage has not changed since July of 2009, when it jumped from $6.55 per hour to $7.25 per hour in the last of a series of scheduled increases.

As a result, Nevada’s minimum wage and overtime rates have remain unchanged for a decade. However, the Constitution of Nevada requires the Office of the Labor Commissioner to recalculate the minimum wage rate every year regardless of whether the federal minimum wage rises. The Labor Commissioner is also required to publish a bulletin on April 1 of every year, announcing the adjusted minimum wage and overtime rates to take effect on the following July 1.

The state Constitution additionally requires every employer to provide their employees with written notification of the adjusted annual rates. The Labor Commissioner includes the Minimum Wage and Daily Overtime Annual Bulletins on its list of required employer postings, indicating that “written notification” must be accomplished via posting the notices in the workplace where they are visible to employees.

The requirements established by the state Constitution – that the Labor Commissioner publish a bulletin, and employers provide it to their employees – do not include an exemption for circumstances in which the rates do not change. These agency and employer responsibilities are in place regardless of whether the minimum wage and daily overtime rates actually change. As a result, employers must update their workplace posters every year to provide the updated Minimum Wage and Daily Overtime bulletins.

What’s Next for the 2019 Nevada Minimum Wage?

Starting January 1, 2020, employers who offer health benefits will need to ensure that benefit plans are compliant with a new health care law. In order to pay an employee the lower minimum wage of $7.25 per hour, the employer must make a qualifying health benefits plan available to the employee and the employee’s dependents. Senate Bill 192, which was enacted during the current legislative session, sets specific requirements for qualifying health benefits plans, mandating that they provide coverage for:

Starting January 1, 2020, employers who offer health benefits will need to ensure that benefit plans are compliant with a new health care law. In order to pay an employee the lower minimum wage of $7.25 per hour, the employer must make a qualifying health benefits plan available to the employee and the employee’s dependents. Senate Bill 192, which was enacted during the current legislative session, sets specific requirements for qualifying health benefits plans, mandating that they provide coverage for:

- Ambulatory patient services

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services, including behavioral health treatment

- Prescription drugs

- Rehabilitative and habiliative services and devices

- Laboratory services

- Preventative and wellness services and chronic disease management

- Pediatric services

- Any other health care service or coverage level required to be included in an individual or group health benefit plan under Nevada’s insurance laws (NRS Title 57)

Qualifying health benefits plans are also required to provide a level of coverage that is designed to provide benefits that are actuarially equivalent to at least 60% of the full actuarial value of the benefits provided under the plan, or health benefits pursuant to a Taft-Hartley trust and qualified as an employee welfare benefit plan.

The Nevada Legislature has also made moves to increase the state minimum wage, although none have been finalized. On May 28, 2019, the Assembly approved Assembly Joint Resolution 10, which proposes to amend the state Constitution by increasing the minimum to $12.00 in July of 2024. The amendment would also eliminate the lower rate for employers who offer health benefits. In order to come into effect, AJR 10 will need to be approved by the Senate, passed again by both chambers during the 2021 session, and then approved by voters during the 2022 general election.

The Assembly also recently passed Assembly Bill 456, which also calls for the state minimum wage to reach $12.00 in July of 2024. However, this bill would schedule a series of gradual increases, starting with a hike to $9.00 per hour in July of 2020. The bill would also maintain the lower minimum wage rate for employees who are offered qualifying health benefits, starting at $8.00 in July of 2020. AB 456 is currently in committee in the Senate and awaiting further action. CPC will continue tracking these bills and more through the 2019 Nevada legislative session.

KEEP IN TOUCH WITH CPC!

To keep up with the latest in labor law news and posting compliance, follow us on Facebook, LinkedIn, or Twitter or subscribe to this blog! You can also contact us by phone, via email, or by chat to order one of CPC’s signature labor law compliance products or learn more about posting obligations for your location or industry.

Please keep in mind that we are unable to provide legal advice.

|

|