Louisiana law requires employers with 20 or more full-time or part-time employees to post an Earned Income Credit (EIC) Notice to Employees informing employees of the annual federal Earned Income Tax Credit (EITC) eligibility requirements. (R.S. §1018.2) Earned Income Tax Credits are reductions in federal income tax liability for which an employee may be eligible if the employee meets certain requirements.

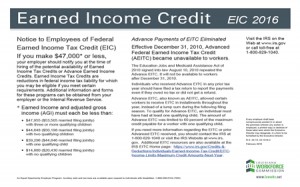

The Louisiana Workforce Commission (LWC) issues the official form of the EIC Notice that must be posted each year by covered employers. The EIC Notice advises employees of the potential availability of earned income tax credits and the current income eligibility requirements. The income eligibility limits differ depending on the employee’s tax filing status and the number of qualifying children, if any, the employee has. The income amounts are established each year by the federal Internal Revenue Service. Also, employers are required to provide new employees, whose anticipated wages for 2016 are $47,000 or less, notice that they may be eligible for the EIC at the time of hiring.

Louisiana All-On-One™ Labor Law Posters and Mobile Poster Paks™ can be updated using a 2016 Louisiana EIC Peel ‘N Post.™ New Louisiana All-On-One™ Labor Law Posters include the 2016 EIC notice.