On April 1, 2017, the Office of the Labor Commissioner for the state of Nevada released the annual bulletins for Nevada’s Minimum Wage and Daily Overtime requirements. The rates, which go into effect on July 1, 2017, are unchanged from the previous year:

On April 1, 2017, the Office of the Labor Commissioner for the state of Nevada released the annual bulletins for Nevada’s Minimum Wage and Daily Overtime requirements. The rates, which go into effect on July 1, 2017, are unchanged from the previous year:

An employee who is offered qualifying health benefits must be paid a minimum wage of at least $7.25 per hour. If the employee’s regular wage rate is less than $10.875 per hour, they must be paid 1 and ½ times their regular wage for hours worked in excess of 40 in a workweek or 8 per workday.

An employee who is not offered qualifying health benefits must be paid a minimum wage of at least $8.25 per hour. If the employee’s regular wage rate is less than $12.375 per hour, they must be paid 1 and ½ times their regular wage for hours worked in excess of 40 in a workweek or 8 per workday.

The Constitution of Nevada requires that a state agency designated by the governor publish a bulletin on April 1 of each year announcing adjusted minimum wage and overtime rates, to take effect on the following July 1. The wage rates are recalculated each year according to increases in the federal minimum wage or, if greater, by the cumulative increase in the cost of living. However, the federal minimum wage has not risen since July of 2009, when it jumped from $6.55 per hour to $7.25 per hour in the last of a series of scheduled increases. As a result, Nevada’s rates remain unchanged.

Although the minimum wage and overtime rates have not changed, the Minimum Wage bulletin does include a small but important change in light of a recent court case which clarified a long-cloudy aspect of Nevada’s governing law. Under the state’s tiered minimum wage system, the employer may pay the lower of the two rates if the employee is offered qualifying health benefits. Since the adoption of this system in 2006, some have claimed that the lower wage should apply only if the employee makes use of the offered health benefits, while others argued that eligibility for the lower wage only requires that health benefits be “offered” to the employee.

In October of 2016, the Nevada Supreme Court concluded that “the language is plain” – “offering” qualifying health benefits is defined within the act as “making health insurance available to the employee and the employee’s dependents,” and does not imply that the employee must accept the offered benefits in order for the lower wage to apply. On the updated Minimum Wage Bulletin, the relevant section has been amended to state that the lower-tiered wage applies to “employees to whom qualifying health benefits have been offered/made available by the employer,” reflecting the court’s emphasis on the availability (rather than acceptance) of benefits as the determining factor.

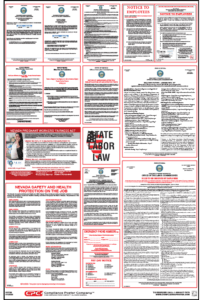

Although employers are required to provide written notification of the annual rate adjustments to each employee, posting of the Annual Minimum Wage and Daily Overtime Bulletins is not statutorily required. However, the Office of the Labor Commissioner does include them on the agency’s list of employer required postings. Accordingly, CPC has updated the Nevada All-On-One™ Poster and Mobile Poster Pak™ to include the 2017 bulletins, allowing employers to fulfill their notification requirements in the form the Labor Commissioner states is required. Order online today using the links above, or call 1-800-817-7678 if you’d like to speak to a Compliance Advisor regarding this update.